7 Different Pricing Strategies to Drive Growth

Pricing is one of the most powerful levers for growth in a business. Even so, most companies do not invest enough time and resources into their pricing strategy. Moreover, many businesses would benefit from leveraging multiple pricing strategies concurrently to optimize price. Instead, underestimating or not acting on the complexity or uniqueness of your business leads to missed profit opportunities or profit loss.

A price strategy is any methodology or process a business uses to determine the price for its products or services. Conceptually, establishing a lucrative price seems like it should be straightforward – bringing in more revenue than the costs your business incurs. However, with this mindset, it’s easy for companies to overlook the importance of choosing a pricing strategy – both the methodology to set price and the underlying structure – that is best suited for business goals.

Pricing actions are incremental by nature, so the right pricing strategy or strategies for your business delivers compound returns over time. This means pricing can quickly become a profit center and augment a business’s ability to invest in other core initiatives. If your pricing strategy isn’t enabling you to meet your business goals, it may be time to reconsider your approach.

Below are 7 different pricing strategies that can help drive profit growth in your business.

Differentiated Pricing Strategy

Also referred to as segmentation-based pricing, differentiated pricing assigns a unique price to a specific customer purchasing a specific set of products or services. Instead of having a singular one-size-fits-all price, this pricing method assigns a price based on the product, service, customer, and order attributes for a given scenario.

Consider two different customers purchasing similar products:

Customer A

- Small customer

- Long tenured

- Minimal growth expectation

Customer B

- Large customer

- New

- Highly competitive

- Rush order

In this scenario, a differentiated pricing strategy would consider the different customer and order attributes to determine a price that best reflects the value provided and the willingness to pay for each customer-product-order combination.

This pricing strategy also places similar-behaving customers into segments. This approach allows for large-scale pricing actions with less risk. A one-size-fits-all pricing approach, or “peanut-butter spread” approach, will create a price that is not in line with customer expectations or willingness to pay. For customers that find your price too high, you risk losing their business. The customers that were willing to pay a much higher price have now resulted in a lost opportunity. Segmenting customers into peer groups based on similar attributes allows you to assign a differentiated price based on the perceived value provided, reduce risk, and optimize profit.

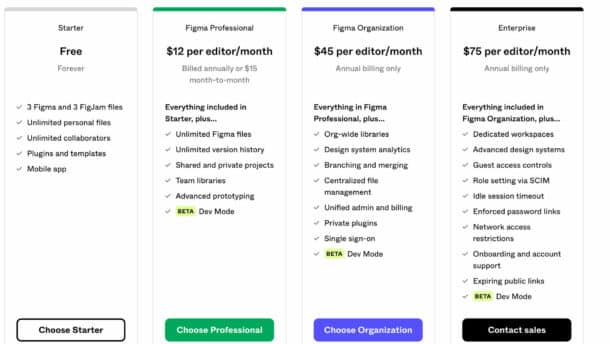

For example, Figma offers different plans catered to different sizes and needs for user:

Why use a differentiated pricing strategy?

This pricing strategy is used when more granular pricing is needed, such as customer-product-specific pricing. Businesses that use differentiated pricing experience reduced risk and benefit from increased profits through optimizing customer expectations and opportunities.

Value-Based Pricing Strategy

Value-based pricing considers market factors to determine price, including:

- Competitive Information

- Perceived Customer Value & Willingness to Pay

- Economic Factors

This pricing strategy begins with understanding your position in the market versus competitors. Businesses can collect competitor intel through industry reports, web scraping, sales feedback, or ongoing market research studies. This information is then used as one input to set price.

However, understanding competitor price alone doesn’t generate a complete value-based price. Market research should be used to understand how your customers view your products, services, and overall brand. Customer willingness to pay and price elasticity are two types of market analysis that help unveil how you are perceived in the marketplace and how your price should reflect that.

Another input to value-based pricing is economic factors. If your business utilizes raw materials or commodities such as metals, oil & gas, or agricultural products, the variability of market cost should be accounted for in your pricing methodology.

Combining competitive data, market data, and microeconomic information, this pricing strategy accurately positions your offering in the market and your value to customers.

Why use a value-based pricing strategy?

Low price transparency, high perceived value, or emotional reason for purchase are all situations where value-based pricing can be very effective. Businesses in highly competitive markets also benefit from understanding and leveraging their position in the market. While complex, utilizing both market and customer factors will lead to higher profits.

Dynamic Pricing Strategy

Dynamic pricing is a pricing strategy that has the flexibility to adjust price based on changing market or business variables. Factors that influence price include cost indices, supply/demand seasonality, competitiveness, changes in customer behavior, and inventory. Dynamic pricing accounts for these variables quickly – providing an almost instant price or quote based on the existing variables at the time.

One of the most familiar industries that uses dynamic pricing is the airline industry. There is typically a sweet spot for when to book the cheapest flight, and most people have shared frustration over a wild price change that occurred in just a matter of days – or even hours.

While B2B dynamic pricing may not be as drastic, similar principles apply. This pricing strategy is successful at providing a real-time price for a specific customer-product scenario that accounts for market and economic factors at the time of the quote or transaction.

Why use a dynamic pricing strategy?

Businesses that need frequent price adjustments or quotes for new business find dynamic pricing highly effective. This pricing strategy is also beneficial for companies whose costs – raw materials, labor, transportation – are sensitive to market changes and require updated pricing to reflect those changes.

List & Discount Pricing Strategy

A list and discount pricing strategy is very popular for manufacturers and distributors. This pricing approach utilizes an established list price for SKUs and then applies a certain discount off that list price based on the specific customer or transaction. In some cases, the list price is visible to customers and other market participants, making the discount strategy critical for price optimization.

To successfully utilize this pricing approach, the list price needs to resonate with the market. Often, we see sales teams not using recommended pricing because the list price is outdated, which leads to high levels of unearned or unexplained discounting. For this reason, list and discount pricing benefits from incorporating both differentiated pricing and value-based pricing to establish the list price and discount levels.

In addition to a standard discount, a company using this pricing strategy may also deploy special discounts for certain scenarios. This includes promotions, early payments, off-season purchases, or loyalty programs. These types of discounts should be understood at the customer level and aggregated in cost-to-serve analysis to understand customer profitability and where price leaks may be occurring.

Amazon takes advantage of the list & discount strategy very frequently. On a regular basis they’ll send you custom recommendations for discounted items that you were previously viewing on your account. Most of the time the original price is listed along with what the limited time discounted price is currently:

Why use a list & discount pricing strategy?

List and discount pricing sets market-relevant or value-based list prices, and then delivers customer-specific differentiated pricing through discount levels to fully capture the value delivered.

Quantity-Based Pricing Strategy

A quantity-based pricing strategy utilizes the quantity of products or services purchased as the main component to determine price. This pricing strategy – also referred to as volume-based pricing, volume discount pricing, or quantity break pricing – offers customers more favorable pricing when they purchase a certain quantity or volume of a product. Using this structure, a customer is incentivized to purchase more volume while a business’s costs associated with the purchase stay relatively flat or increase slightly, leading to an increase in revenue.

While more volume is often regarded as positive, it’s important to determine the optimal price and quantity to introduce price breaks or discount levels to maximize margins while also understanding the value for the customer. Set your volume discount levels too high and the customer may not see the value; too low and your margin may take a hit.

This pricing strategy is also used for special promotions or programs such as volume-based rebates. To be successful, you’ll need to diligently evaluate whether volume commitments are actually being met or if this technique is leading to a source of leakage to address and potentially manage differently.

Why use a quantity-based pricing strategy?

Businesses with products commonly ordered in bulk benefit from a pricing structure that encourages customers to purchase higher volumes while providing clarity on expected discount levels. For some businesses, such as SaaS or consumer goods, volume-based pricing also offers a greater opportunity for upselling. Additionally, special promotions or programs leverage this pricing strategy to move inventory due to seasonality, utilization or availability, or cost changes.

Packaged & Bundled Pricing Strategy

Packaged and bundled pricing offers a set of products or services at a lower price when purchased together versus when purchased separately. This pricing strategy is well-known across many industries, such as:

- Fast-food meals

- Complementary retail products such as shampoo & conditioner

- Cell phone data plans

- Cable TV

- Software packages such as Microsoft Office or Adobe

In some approaches, a bundle forms a new SKU, or package, and items within that package are only available together. We see this in pricing models that offer “basic” vs. “pro” vs. “elite” package options. In other approaches, a business may allow the customer to purchase individually or as a bundle, such as fast-food meals.

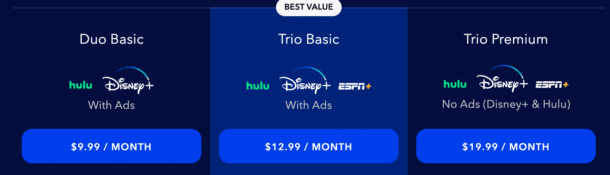

A popular example of packaged pricing strategies is the Hulu, Disney Plus, and ESPN bundle that many people subscribe to because it covers a wide variety of streaming services for a discounted price:

Ideally, packaged and bundled pricing incentivizes customers to purchase something additional and complementary while increasing a company’s margin. This pricing strategy is valuable for:

- Businesses that need to promote certain products or services, whether due to competitive factors, inventory, or promoting a new feature

- Products with certain features that benefit from other complementary features or required functionality

- Products that are understood to perform better when sold together and can be offered through promotional programs

- Brands or industries that require price simplicity or even visibility

Businesses may also use this approach when setting price based on their product positioning. Good / better / best pricing is a popular example of how adding or removing product features, usually based on perceived quality, creates price levels. While this structure may not combine a set of products, it does group a set of product features and incentivizes customers to upsell for a better overall rate when comparing the value delivered.

Why use a packaged & bundled pricing strategy?

This pricing strategy promotes higher profits by selling additional complementary products or features together as a unique package or bundled set of products or services. It can also provide customer benefit through price simplicity. Additionally, businesses that employ complex or specific product positioning strategies will benefit from this structure.

Subscription-Based Pricing Strategy

Subscription-based pricing strategies allow customers to subscribe to a business’s products or services for an established period of time, usually monthly to annually, for a specific price. Often used in SaaS-based companies, access to the products or services is understood and agreed upon up front.

There are several types of subscription-based pricing models, including:

- Flat-rate pricing model: A single product with a single set of features at one singular price

- Tiered pricing model: Multiple products or packages of products that feature different combinations at differing price points

- Per-user pricing model: One user pays one price, and pricing increases as users increase

- Feature-based pricing model: Price is set according to the number of tools and features subscribed to

To optimize price, this pricing structure works well with value-based pricing to set prices based on market and customer value, as well as differentiated pricing to account for customer attributes such as acquisition cost, tenure, and attrition. It can also combine qualities of both quantity-based and packaged & bundled pricing structures to pack and discount an offering.

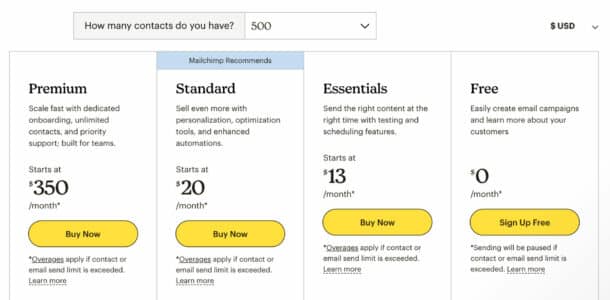

Mailchimp’s subscription plan takes into account how many contacts you are sending to and offers pricing based on that info:

Why use subscription-based pricing?

Subscription-based pricing offers businesses stable, recurring revenue and strong upsell opportunities. It also offers customers a clear understanding of and convenient access to the subscribed services.

Other Pricing Strategies

There are additional pricing strategies not covered above that can drive growth. Below are 3 common examples that can be very beneficial for certain businesses but can easily be misused if not approached correctly.

Cost-Plus Pricing Strategy

Although popular and straightforward, a cost-plus pricing strategy can cause businesses to lose thousands in profit. This pricing strategy applies a fixed markup on top of the cost of a product or service to determine a profitable price. While this can be useful in particularly simple go-to-market plans, businesses using a cost-plus pricing strategy may risk losing profit because they don’t account for the customer perception or market position.

Competitor-Based Pricing Strategy

A competitor-based pricing strategy uses competitor pricing information to determine how to position and set price when compared to competitors. This approach can be highly successful in a consolidated industry, and it is also an important input for value-based pricing. However, it should be closely evaluated before deploying because it doesn’t account for customer value, and it requires businesses to rely on their competitors to set price and respond accordingly.

Penetration Pricing Strategy

This pricing strategy drives growth by offering a considerably lower price than the competition in order to generate sales and market share. Penetration pricing can be effective for new products or markets, as it drives volume very quickly. However, over time you’ll need to raise price to avoid profit loss.

Finding the Right Pricing Strategy for Your Business

There are many different pricing structures to consider, each with benefits and drawbacks. Moreover, your business may need to utilize a set of strategies that accounts for a variety of factors such as competitive landscape, changing costs, customer elasticity, and customer-specific discounting.

The best pricing strategy is one that rewards your business with higher profits, reduced risk, and greater clarity and confidence in decision-making. Price setting doesn’t need to be a daunting experiment with unknown outcomes. The price consulting experts at INSIGHT2PROFIT can help identify the right pricing strategies for your business and then partner with you to ensure it sticks and continues to produce profit growth year after year.