Building Products Manufacturer

Waterfall Insights to Revenue Growth: Turning Data into Dollars

Optimizing Margins: Turning Cost-to-Serve Data into Bottom-Line Growth

A building products manufacturer achieves 8% revenue growth by identifying and addressing low-margin customers and programs.

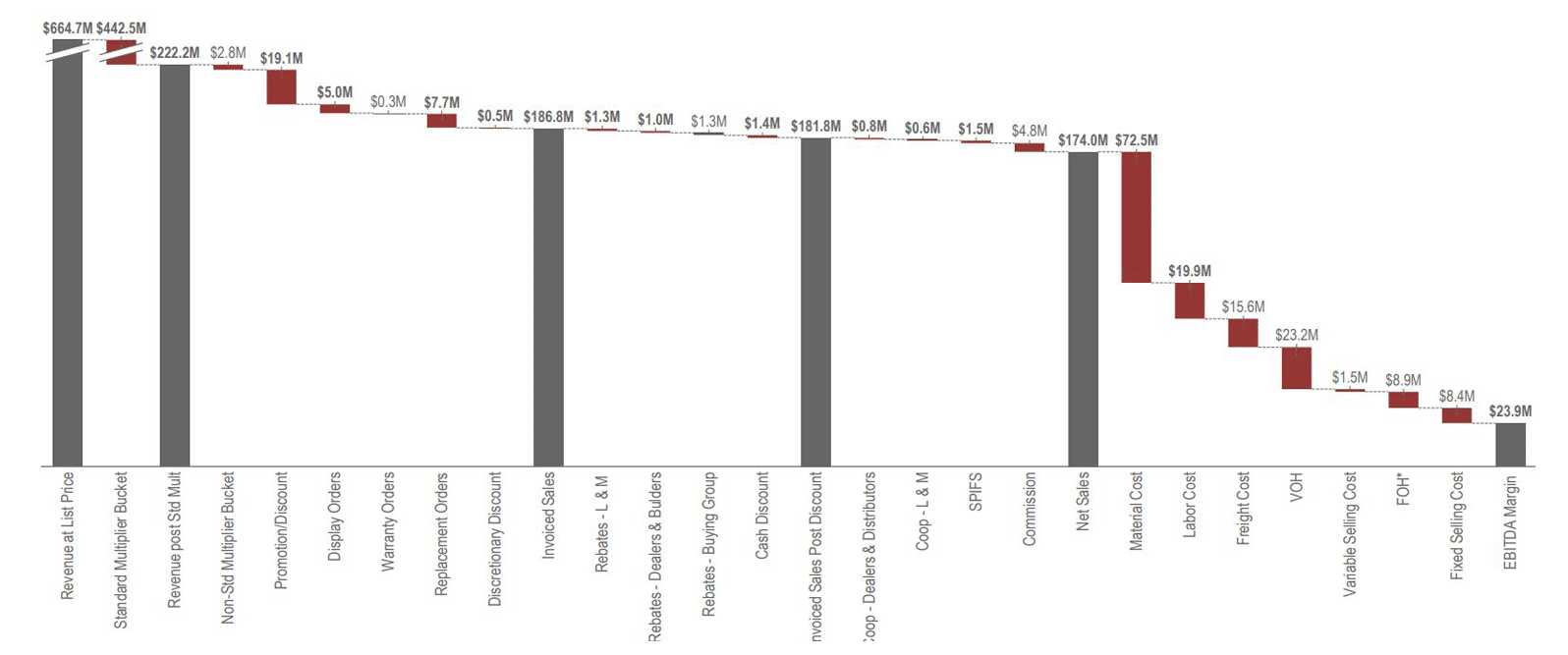

In a highly competitive market, this building products manufacturer faced the daunting challenge of navigating a complex pricing structure with numerous programs and incentives aimed at growth. Despite efforts to adjust prices in line with raw material cost increases, margins continued to erode due to a mix of high discounts and low-margin customer segments. By consolidating over 250 data files into a detailed cost-to-serve waterfall analysis, the company uncovered hidden inefficiencies and designed targeted strategies to eliminate value leaks. The result? A significant 8% increase in bottom-line revenue and a stronger foundation for sustainable profitability.

Explore More Case Studies

Situation

Complex Pricing Structures Reveal Hidden Margin Challenges

- Highly complex pricing waterfall with many programs and incentives aimed at driving growth

- Raised prices with raw material increase but were not seeing pull-through to margin

- While average discounts had been declining since prior price increases, weighted average discount increased due to customer mix

Cost-to-Serve Waterfall

Approach

Data-Driven Strategies to Optimize Cost-to-Serve and Drive Profitability

- Consolidated over 250 data files to build transactional waterfall

- Identified low margin customers and products and compared with peers to identify outlier situations / patterns

- Redesigned programs related to year-end and quarterly rebates, promotions, service levels, freight, and customer discounts

Strategic Pricing Actions and Their Financial Impact

| Pricing Action 1 | Customer | Description | Revenue | Impact |

|---|---|---|---|---|

| Eliminate National Promotions | Dealers & Distributors | Gradually eliminated all national promotions | $xx | $20M |

| Discount Decreases | Dealers & Distributors | All major product lines had two increases 4 months apart, 3-4% each | $xx | $14M |

| Buying Group Contract Changes | [Buying Group Name(s)] | Updated contract terms | $x | $250K |

| Customer Specific Price Changes | 55 Low-Margin Customers | Price increase for specific product lines by 7-10% | $x | $500K |

| Customer Specific Service-Level Changes | Customers with High or Low Utilization | Sent termination letters; freed up capacity | $x | TBD |