Pricing in a Volatile Market

We are in unchartered waters of a global pandemic and macroeconomic uncertainty. In this environment, how should businesses adjust their strategies to best address the unpredictable market? Are price cuts – or price increases – warranted to protect growth and margins?

Pricing in a volatile market is challenging. Dramatic pricing decisions can have a lasting effect on the profitability profile of a business long after a downturn. Conversely, best-in-class businesses use market volatility to their advantage by identifying opportunities to maintain, and even expand margins and reset their profitability. Now is not the time to overreact. Rather it’s a time when data analytics can help considerably to make informed decisions. With the right strategy, tools and approach, businesses can turn what appears to be a poor market situation into greater profitability and improved market positioning in the long-term.

What To Do

Resist the urge to immediately lower pricing. Impulsive decisions often have unanticipated consequences. If competitors respond with their own price reductions, it could start a price war that will decrease industry profitability across the board and reset the competitive dynamics in the market for years to come. A lower price in the downturn becomes a new normal in the minds of customers and sets new reference price and margin expectations for the business. And when the market rebounds, there’s no guarantee that price increases can recoup lost profitability.

In the same vein, don’t mirror competitor behaviors without a data-driven strategic review. These actions may trigger a race to the bottom all market participants want to avoid. Try to balance the need to stay competitive against implementing a policy that will reduce industry profitability.

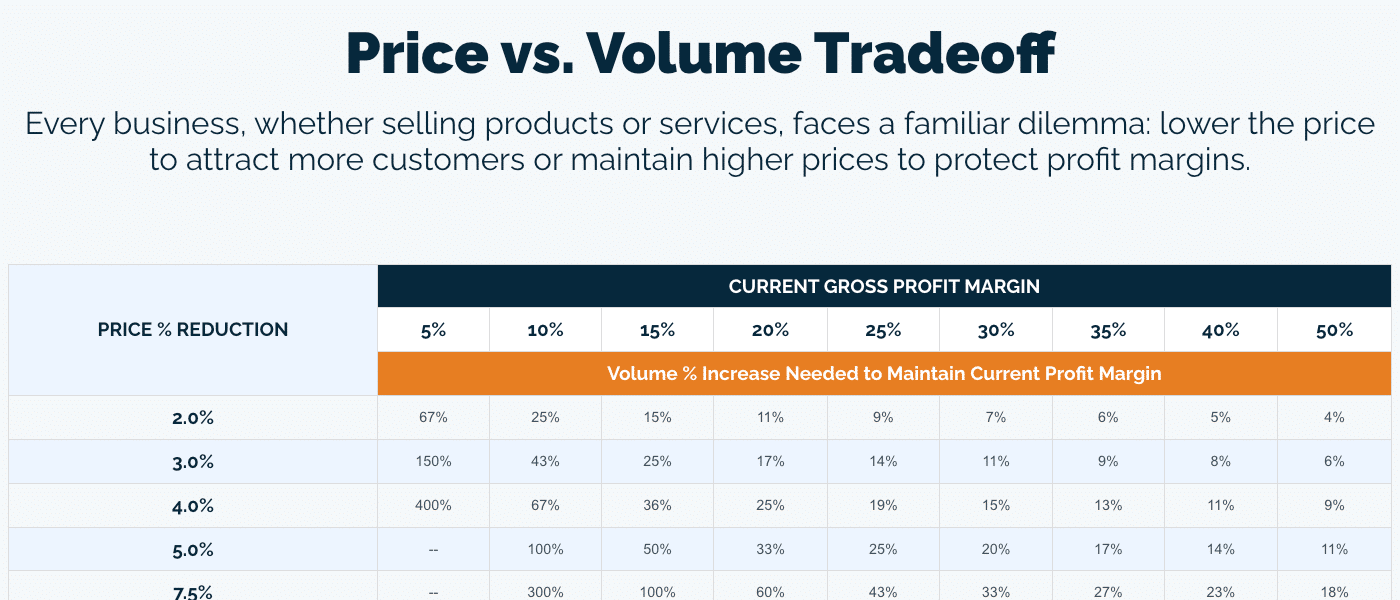

Before taking any action, it is important to understand how (if at all) the business’s value proposition and pricing power has changed during the downturn. Do customers perceive the value of the company’s products differently? Will there potentially be long-term damage to the company’s target market or customer base as a result of the short-term situation? How price elastic are the business’s product and service offerings? These factors all play into pricing strategy. For example, businesses whose offering represents a small percentage in a value chain that has had external demand shocks could drop their prices to near zero and see no volume uplift. In these instances, reducing price as a quick reaction reduces the profitability of the unaffected demand, and creates a challenging and lower desired price reference point for when the affected demand rebounds.

Short-term market fluctuations happen, but rarely does a short-term environment change long-term goals. If the company’s value proposition and long-term strategy are unchanged, then typically the overall pricing strategy should stay in-tact as well. Don’t erode market perception in the face of short-term challenges if at all possible. It’s best to remain true to the core value proposition of the business, its competitive advantage and its long-term strategic vision–even in a downturn.

Despite the overarching goal of holding steady in the short-term, sometimes price reduction becomes a necessity in an area of the business or a specific market due to a highly price-sensitive customer group, for example. A good approach in this situation is to implement a short-term pricing program, such as a limited term promotion, rather than to make across the board price cuts.This allows for targeted price reductions as needed and is a way to allow prices to adjust within tolerance set by the business.

In a volatile market dramatic cost changes create “noise” that may open the door to profit improvement opportunities. As costs go either up or down, and companies assess whether to pass through those cost changes to customers, it offers the opportunity to expand margins across less sensitive items and correct low margin outliers with pricing adjustments. It’s a perfect time to review the company’s total cost to serve its customers and align the value provided with the price customers pay. For example, tariff changes in recent years drove up the cost of goods in many industries, prompting companies to revisit pricing. INSIGHT2PROFIT helped many businesses identify the optimal pricing strategies to cover these costs while at the same time enhancing margins where possible.

An Analytics-Driven Approach will Produce ROI

Taking advantage of cost change situations requires the ability to do a detailed, data-driven pricing analysis. A deep dive analysis of segmented customer, product and order data is, in fact, critical to decision-making, especially in a volatile market. After all, customers, orders and product competitors are all different and these dynamics factor into target price. As part of this analysis companies must understand their relative position in the market so they don’t make decisions they cannot carry out effectively. Following an analytics-based approach helps companies turn what can appear to be a poor market situation into greater profitability in the long-term. For example, companies that work with INSIGHT benefit from our rigorous analytics of detailed transaction data, which provides clarity on commercial opportunities and risks to improve profitability. We take the guess work out of pricing to help clients achieve the profit they deserve for the value they deliver.

With the right strategy, tools and approach, companies can identify and implement price changes that deliver bottom line results quickly, often within three to six months. And the payoff can be impressive. For a recent client, INSIGHT delivered over 20% profit improvement. We know that it’s not just about getting to the best strategy. It’s about driving impact through effective implementation, measuring results and making adjustments over time to deliver results and realize ROI. With every client engagement, INSIGHT measures impact to ensure realized gains.

What’s the Net-Net?

Market volatility is, by definition, unpredictable. It can be hard to fight the urge to make quick pricing decisions, but INSIGHT’s experience shows that utilizing data to drive decisions and exercising objectivity is the best short and long-term strategy. However, if prolonged volatility begins to affect companies’ cost basis due to supply chain or other implications, revisiting pricing strategy can uncover hidden benefits. It’s an opportunity to maintain margins by passing through costs but, importantly, it’s a chance to identify areas where margins can be maintained, and even expanded through optimized pricing.