5 Trends Product and Pricing Managers Can’t Afford to Miss

Twenty years ago, Six Sigma and lean manufacturing burst onto the scene, helping industries cut costs and drive profits like never before. Now that the dust has settled and businesses are looking to other aspects of their operations to drive profitability, what are they focusing on?

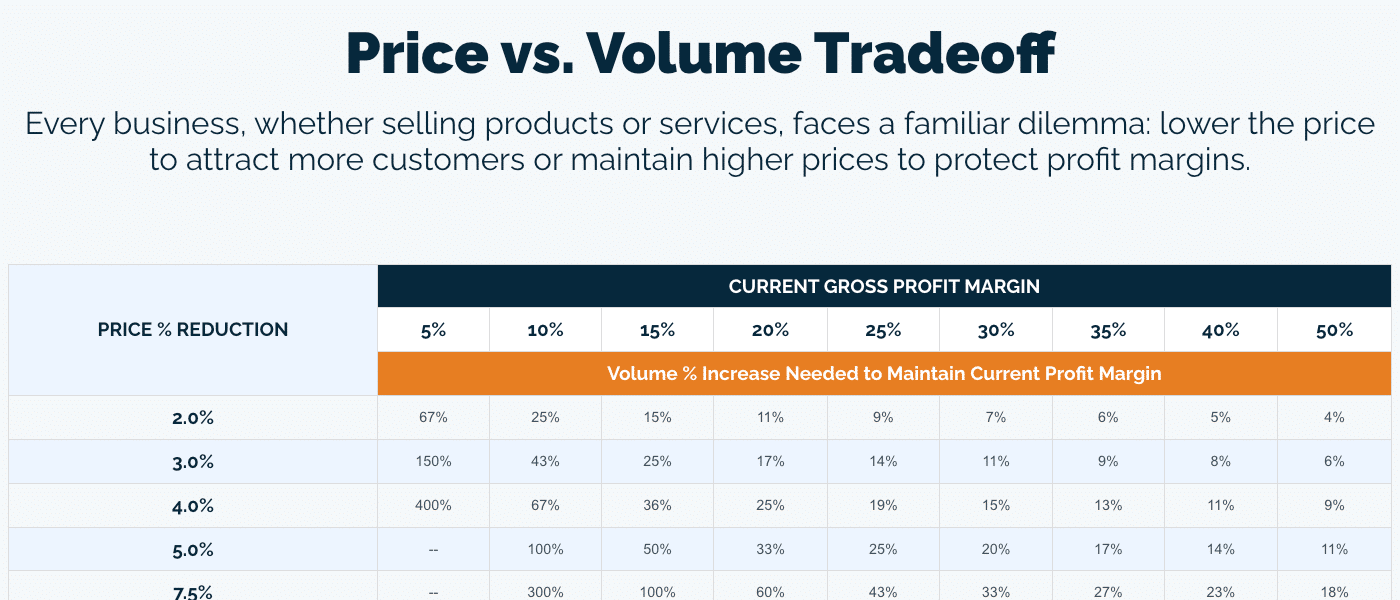

Increasingly, business leaders are looking to pricing as their greatest opportunity for improving profits. No longer seen as merely a means to drive sales volume, pricing strategies now play a significant role in forward-looking business decisions. Below are five pricing trends smart companies are taking advantage of now—and you can’t afford to ignore any longer.

1. Value-based pricing is replacing cost-plus pricing

If you’ve ever tried to buy a last-minute airline ticket to Florida during spring break season, you’ve experienced the power of value-based pricing. More and more, businesses are realizing value-based pricing is one of the fastest ways to maximize profitability.

Value-based pricing incorporates a customer’s perception of value – that is, the customer’s willingness to pay more for a specific product or feature, relative to alternatives. In this model, setting prices becomes a more complex process, requiring deep insights into the mindset of the customer. But as businesses become more customer-centric, they’re also becoming more adept at communicating value to their customers.

Freed from a cost-based mindset, businesses that embrace value-based pricing are well positioned to market specifically to a customer’s willingness to pay, which in turn opens up more opportunities for higher profits.

2. Pricing strategy is becoming more clearly defined and systematically managed

Imagine this scenario: A sales representative, eager to attract a promising customer, offers the customer a deep discount in the hope of securing a large order. Although the customer places an initial order, it’s relatively small. Over time, the customer continues to place small, infrequent orders, and the large order never materializes. However, the price is never reset to its original, higher level. The customer continues to benefit from the discounted price, while the manufacturer continues to lose margin on the sales.

This scenario is all too common. Fortunately, mindsets are changing. As businesses become progressively more price-savvy, they are beginning to move away from ad-hoc pricing decisions and instead implement standardized pricing policies. These policies are establishing targets and measurable goals for achieving price increases, as well as clearly defined workflows and rules for handling pricing exceptions.

Additionally, as these overall pricing policies begin to bear results, smart businesses are taking it a step further and developing segment-specific policies. This allows businesses to align pricing decisions with specific customer needs and further shape customer purchasing behavior.

3. More companies are employing dedicated pricing managers.

According to the Professional Pricing Society, fewer than 5 percent of Fortune 500 companies today have a full-time function dedicated to pricing. And yet, as more businesses adopt standardized pricing policies, a central pricing authority will play a pivotal role in business’ ongoing profitability improvements. At companies smart enough to have them, pricing managers are the ones tasked with transitioning organizations from cost-plus pricing to true value-based pricing.

On a deeper level, the pricing manager is responsible for managing pricing performance. He or she is the one person who asks such critical questions as:

- How consistently are we achieving our price increases?

- Are we capturing all of our manufacturing costs?

- How often should we revisit our rebates?

- Was our latest promotion profitable?

The answers to these questions yield important insights that continue to improve the accuracy – and profitability – of pricing models over time. As a result, the pricing manager’s input is becoming much more important to company leadership and is being actively sought out by both executives and management teams throughout the company.

4. Pricing managers are demanding actionable, transaction-level data

There’s an old business saying that goes, “You can’t manage what you can’t measure.” As pricing strategies become more sophisticated, pricing managers are increasingly demanding highly detailed, transaction-level data that they can act upon.

Consider again the scenario where a customer receives an ongoing discount despite small orders. Now consider what happens when the pricing manager has access to transaction-level data that allow him to easily compare pricing variants. In this new scenario, the pricing manager prepares a scatter chart, where the X-axis represents customer orders and the Y-axis represents product price per order. Each dot on the scatter chart represents the size and price of each customer order over a specified time period. Discrepancies in price immediately become evident, and now the pricing manager is in a position to assess the situation and make a decision. Why did the large order never come through? Should the discount be eliminated? Can the customer relationship be revived? Would a different approach result in more sales?

Without the transaction-level data needed for this analysis, the incorrect discount could go unnoticed for years. These important questions might never be asked, and a potentially profitable relationship would never be salvaged.

5. Pricing-specific business applications are replacing spreadsheets and enhancing BI tools

The challenge with data is it must be actionable in order to be helpful. And while traditional BI and ERP systems can suffice for helping you make big-picture decisions, they often just serve up pretty graphs without offering you pricing information you can truly act on.

Often, transaction-level data is contained across multiple systems, forcing pricing managers to laboriously hunt and peck to find it. Every time a pricing manager notices something alarming – for example, that margins slipped a half percentage point last month – it’s an exhaustive process to find the data that will explain the trend. When found, the data often lacks proper attribution that exposes causality. As a result, in order to manipulate and analyze the data, pricing managers must manually export the data into a spreadsheet that is ill-equipped to the task and doesn’t lend itself to easy analysis and insight.

To overcome these challenges, companies are using pricing-specific business applications to extract the insights they need. These applications contain scorecards, dashboards and alerts that transform transactional data into actionable information, allowing pricing managers to have more time for analysis and critical thinking—and more opportunities to make a difference in their companies.

Perhaps the consistent theme across these trends is the value pricing insight is bringing to businesses smart enough to take advantage of the opportunity. As business leaders gain the framework, expertise and tools to make sophisticated pricing decisions, they are steering clear of the old methods of setting prices based on assumptions, gut intuition and incomplete knowledge. As a result, they are poised to be more strategic than ever, driving more sales and earning even higher levels of profits.