Are Discounts Hurting Your Profitability?

Discounts, promotions, and loyalty programs—are all relatively common business strategies to stimulate sales and increase revenue. So, when it comes to incentivizing new and existing customers, it’s easy to lean on price cuts, bundles, and sales to get the job done. Discount pricing is complicated, though. Without the right research, data, and pricing strategy, discounts have the potential of holding your business back as opposed to driving profits forward.

Discount pricing is far from foolproof. That is why choosing whether (and when and how) to offer discounts needs to be just as strategic of a business decision as determining your initial pricing strategy. Thankfully, when done right, discount pricing can have a lasting positive impact on sales growth and customer acquisition.

In this article, we break down the influence discounts can have on your bottom line, as well as what you can do to increase profits while avoiding costly miscalculations.

Long Term Impact of Pricing Discounts

Discounting your products and services can lead to short-term profitability, but what is a discount’s long-term impact on profits? Let’s look at an example:

You’re a SaaS company that prices its product at $100 per unit, and you have a cost of $20 per unit. For every sale, your gross margin is $80. Assuming your overhead is $10,000 a month, you’ll need to sell 125 units to break even.

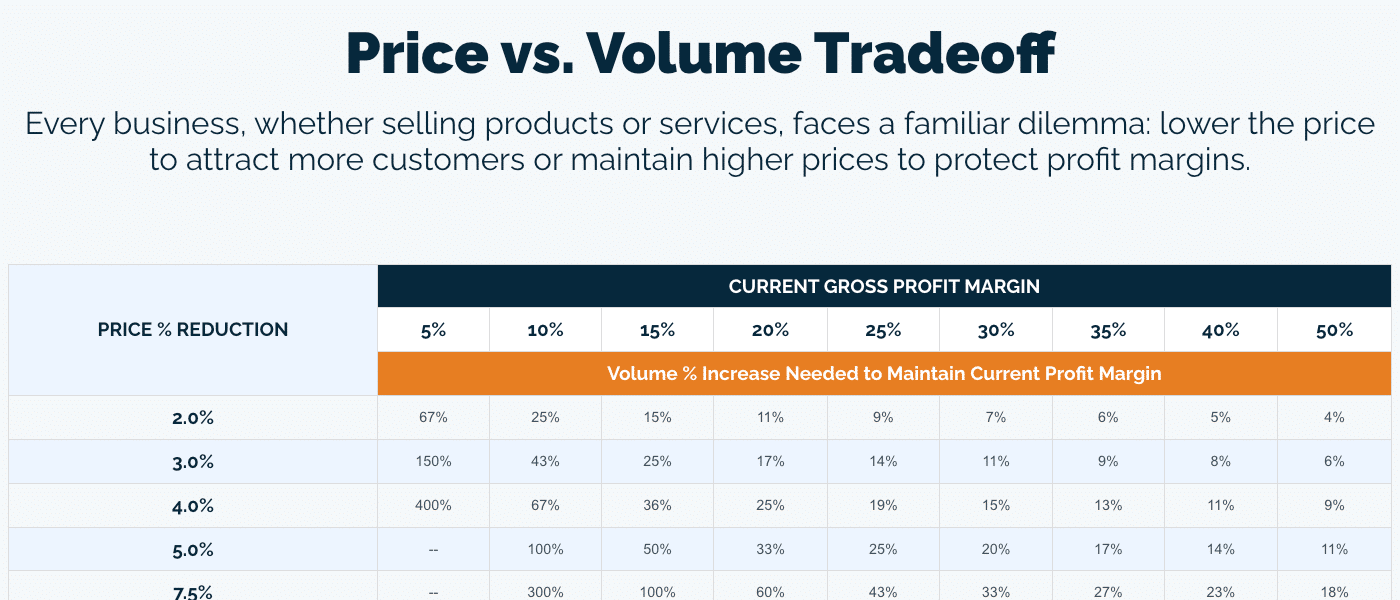

Now, say you want to increase your sales, so you offer a temporary 20% decrease on your product. Your gross margin adjusts to $60, which means instead of selling 125 units to break even, you now have to sell over 166 units. That means you’ll need to sell 33.3% more units to cover your 20% discount.

Margin analysis like this sheds light on two potential concerns with discounting. To start, lowering your price without a defined plan or strategy can erode profits. Next, when the price of your product or service decreases, unless you have a defined sales strategy, your sales effectiveness can be impacted.

Discounting as Part of an Overall Pricing Strategy

Cash is constantly moving into and out of a company, and the number one cause of cash flow issues for most businesses is pricing. The wrong pricing strategy can wreak havoc on your bottom line, and that includes your discount pricing strategy. If there is one truth we are absolutely sure of at INSIGHT2PROFIT, it is that data drives everything. If you don’t have the time and resources to do the necessary data research and analysis, discounts should not be your long-term solution to cash flow concerns.

When paired with the right information and the right strategy, however, discounting can have significant benefits:

- Attract new or inactive customers

- Reach sales targets during a slow sales period

- Improve cash flow

- Help identify willingness to pay

- Move stock

To determine the appropriate type of discount strategy for your business, you first need to establish standardized discounting targets and guardrails based on your primary business objectives. Your discounts should be a reflection of your overall goals, including:

- Customer acquisition

- Customer retention

- Clearing out inventory

- Customer win-back

If your main objective, for example, is to build brand loyalty and reward existing repeat customers to ensure customer retention, you will want to make sure your biggest discounts aren’t going to your smallest revenue tier customers. Instead, you will want to consider a loyalty program that drives profitable customer behaviors by rewarding customers that exhibit those behaviors.

To identify different groups within your audience—loyal customers, prospects, on-the-fence purchasers—you can perform a segmentation study. In doing so, you are able to gather valuable insights like identifying the markets where your value proposition is strong enough to stand on its own, as well as finetuning your discount strategies to optimize success and reduce price leaks.

Benefits of a Segmentation Study

While one potential customer may deem a base price as too high, and therefore never convert without a discount, another customer may be willing to pay even more for a product or service than its initial standard price.

With price segmentation, a range of prices exists for the same product. The price varies based on the type of customer making the purchase. The impact this type of customer segmentation can have on your bottom line is huge. Here is an example:

Say you have a product that sells for $10. A portion of your audience feels like $10 is too much, and therefore will not make a purchase. Another portion of your audience would actually pay $15 for your product because of the high value you provide them. Your total loss in this situation would be $15— the $10 you didn’t make from the first customer, and the $5 you missed out on from the second customer.

Now imagine you have different prices for the different segments of your audience. You offer $5 for the group that felt $10 was too high, and $15 for the group with the higher willingness to pay. Now, instead of losing $15, you’ve made a $5 dollar sale and a $15 dollar sale.

A segmentation study can help determine different audiences to better understand factors like consumer behavior and lifetime value. By performing a segmentation study before locking in a discount strategy, you reduce your risk of profit leaks through unearned discounting, misunderstanding of perceived value, and ineffective sale strategies.

Discount Pricing and Sales Effectiveness

One of the most overlooked factors that contributes to the effectiveness of a discount strategy is your sales team. Unless everyone is on the same page about who should get what discount and when, you could be experiencing a significant amount of avoidable profit loss. Luckily, there are ways to evaluate your sales effectiveness and identify any areas that need improvement. One of these methods is a cost-to-serve waterfall analysis.

Cost-to-Serve Waterfall Analysis

A cost-to-serve waterfall analysis can reveal inconsistent usage of discounting policies by evaluating elements like rebates, payment terms, standard and special discounts, and promotions to help determine your pocket margin. From there, the data and research collected can be used to determine whether the investments your organization has elected to make in order to drive your customers to purchase are either making or costing you money, and why. While an existing policy may not be serving your bottom line, another culprit could be a lack of sales adherence to existing processes.

Once profitability is better understood, sales training, incentives, and guardrails provide the structure needed to set boundaries and enforce when certain customers receive certain discounts. This can be accomplished through commission plans, easy-to-use tools that promote behavior and codify processes, and a cadence of granular sales performance reporting that promotes accountability.

How to Build a Data-Driven Pricing Strategy that Works

At INSIGHT2PROFIT, we believe developing an effective pricing strategy is as much art as it is science. We see beyond the short-term profits and unsustainable pricing strategies so that we can better inform our clients on what they really need to drive growth.

If you need help finding a strategic pricing solution that works for your business, contact us. Our pricing experts have the knowledge and know-how necessary to design customized pricing solutions that will immediately impact your bottom line.