Price Sensitivity: What It Is, How to Measure It, and the Ways Price Impacts Buying Behavior

Understanding the role price sensitivity plays in the demand for your products or services is critical to capturing value, reducing churn, and maximizing profits. According to Bain & Company, 85% of companies say they have significant room for improvement in pricing.

When your business understands how sensitive your customers are to price and their expected purchasing behavior, it strengthens your pricing strategy, enabling you to:

- More accurately capture customer value

- Incorporate changes in macro- and microeconomic conditions into price recommendations

- Reduce the risk of customer price concessions or customer churn

- Optimize price recommendations for maximum profit

Furthermore, it can provide detailed, data-driven knowledge about the underlying cause of margin or revenue shifts and the steps required to mitigate risks and maximize profits.

Let’s explore the numerous benefits of understanding price sensitivity and how you can utilize this critical intelligence to build a pricing strategy that optimizes results.

What is Price Sensitivity?

Price sensitivity reflects how price impacts customer purchasing behaviors. If a change in price considerably affects a change in purchase behavior (quantity, frequency, brand, channel), then the sensitivity is considered high. If purchase behaviors do not change, then sensitivity is low.

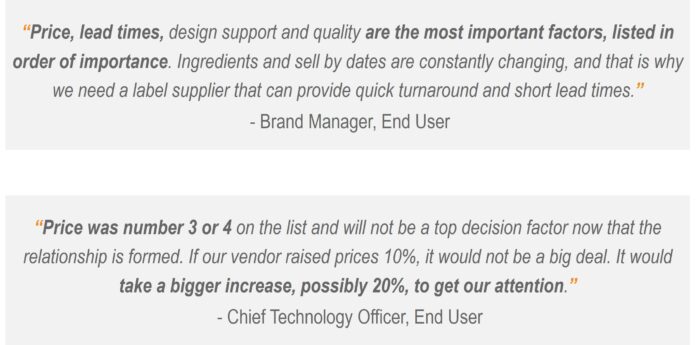

A customer’s level of sensitivity can vary with the level of importance placed on price versus other purchasing criteria. For example, if a customer places significant value on quality and timeliness, they may not be as sensitive to changes in price if the other criteria are being met. The sensitivity can also vary from customer to customer or product to product. Additionally, it varies across specific customer or product qualities, such as regional or industry preferences, brand, or complexity.

Unfortunately, many companies overestimate customer price sensitivity. This is particularly true in B2B where there is often a tendency, especially by sales teams, to attribute specific losses and overall drops in demand to price, even when other factors are the key drivers. A robust market research motion and other after-action processes can help better ground the organization on the true root causes and enable actions based on facts rather than fears. Market research can help to identify, for example, the degree to which a drop in volume is attributable to pricing, overall industry trends, or other factors.

How do You Capture and Measure Price Sensitivity?

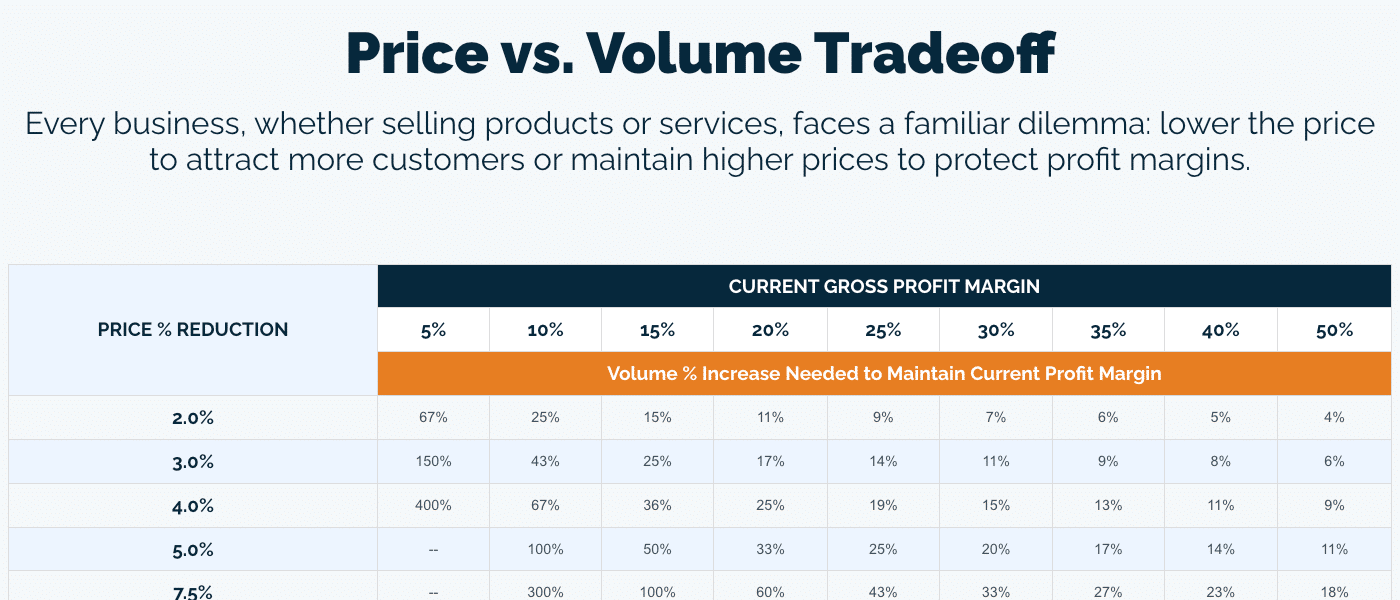

Leading companies have clarity on the strategic objectives they aim to drive through their pricing decisions (e.g., share growth, revenue growth, volume growth, profit growth) and the tradeoffs they are willing to make to achieve those objectives. This requires driving strategic clarity, modeling the specific product or service’s economics (e.g., the impacts on revenue, volume, and profit at various volume levels), and developing an elasticity estimate to answer questions such as: “What would you have to believe regarding the volume response for this action not to be a good idea?” and “How significant of a volume response should we expect there to be in response to such a change?” Armed with these insights, decision makers can reach more targeted pricing decisions. Additionally, A/B testing can help companies observe real-world responses to price adjustments within specific customer segments and product cohorts. This empirical data helps guard against overreactions to emerging outcomes and enables fine-tuning of pricing strategies for optimal results.

Many factors affect a customer’s price sensitivity and subsequent purchasing behavior, including:

- Availability of substitutes

- Barriers to switching suppliers

- Time constraints/urgency

- Customer Value Factors

- Perception of your product or service relative to competitors

- Market shortage or surplus

- Economic environment

- Customer profile (affluence, age, education, geographical location, lifestyle, etc.)

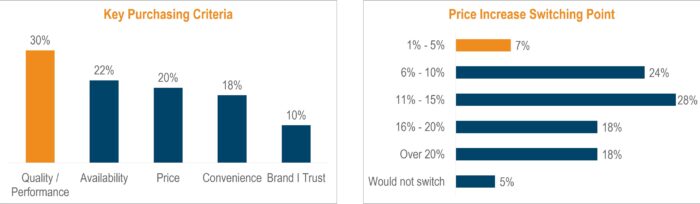

Companies typically have more pricing headroom than they believe they do. When companies conduct robust market research into their customers’ and prospects’ key buying factors and potential tradeoffs (e.g., non-pricing factors), they often find that factors other than price are more important to purchasing decisions:

- Service levels

- Relationships

- Supply assurances

- Ease of working with a supplier

- Contract architecture

- Flexibility on commercial terms

- Timing or flow of payments

Even in commodity-like business, these factors may trump the importance of price levels. Companies armed with this data can better position themselves for success, whether defending their business with existing customers or trying to win new business from competitors.

To establish a robust view of customers that incorporates as many of these factors as possible, the best pricing leaders utilize all available data to capture the most accurate level of price sensitivity. There are two main sources of data to capture: 1) internal historical data and 2) external market data.

1) Internal Historical Data

There is a treasure trove of information sitting in your historical transactional data. By extracting and analyzing large amounts of this data, companies can surface countless customer, product, and pricing patterns and trends and predict customer behavior. Analyzing historical customer behavior can be a window into future customer behavior. Take two examples:

Example 1: Over the last 3 years, your business conducted 5 differentiated price adjustments. Despite this, one of your largest customers is having a declining margin due to extensive customer-specific discounting. The root cause could be many factors, such as unwarranted discounting delivered through the sales team. Or there could be high or changing levels of price sensitivity caused by competitive factors or a change in buying behavior that must be addressed to manage margin and risk.

Example 2: A company’s northwest region has seen a sudden decline in demand for a certain product line; however, this isn’t in line with other regions or historical purchasing patterns. Changes in the market conditions for customers are possibly highly price sensitive in a region where willingness to pay is lower because the product is considered nonessential versus other regions.

These scenarios illustrate the importance of utilizing historical trends to consider how price sensitivity affects your business’s margin and revenue.

Example analyses that indicate or track the level of sensitivity:

- Win rate

- Price index

- A/B testing within specific customer and product cohorts

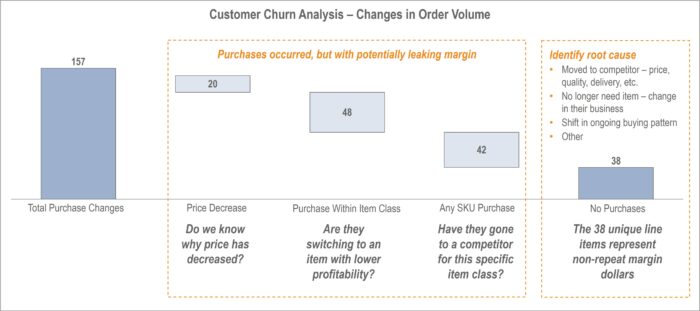

- Customer churn

- Competitiveness

- Margin / Revenue trends

- Price-volume trends

- Seasonality trends

2) External Market Data

Market research studies collect information from relevant market participants to ascertain the role of price in customer behavior. Several market studies can be utilized to answer critical questions, such as the one below, and paint a more well-rounded depiction of your customers’ sensitivity to price.

- Willingness to Pay: How much will a customer pay for a product or service?

- Purchasing Criteria: What factors do your customers care most about when purchasing your product or service?

- Purchasing Process: What processes do your customers use to make a purchasing decision (e.g., decision-makers, frequency, triggers)?

- Value Mapping: Which customer segments value which product or service attributes, and to what degree?

- Competitive Landscape: Benchmark your offering versus competitors, especially in the eye of the customer.

There are two main approaches to answering these critical questions:

1. In-Depth Interviews

Conduct meaningful one-on-one conversations with targeted industry participants to collect the voice of customer qualitative data. Interview questions may include core value drivers or competitive perceptions. Customer feedback, such as the one below, provides insight into your customers’ sensitivity to price.

2. Quantitative Surveys

Deploy a set of closed-ended questions to a statistically significant sample of targeted respondents to collect quantitative insights on perceptions and behaviors. Additionally, specialized survey methodologies can be used alongside traditional survey questions to augment learnings, including Conjoint Analysis, Gabor Granger, Max-Diff Analysis, and Van Westendorp. These analyses help pinpoint optimal price points based on customer feedback.

Conjoint Analysis

Conjoint analysis is a statistical technique that utilizes data from quantitative surveys to understand how people value different product or service attributes. In pricing, conjoint analysis is used to understand the relative importance of each product attribute, thereby revealing where the value to the customer lies. This analysis helps businesses understand which features drive value and, therefore, what might cause one customer to be more price sensitive than another.

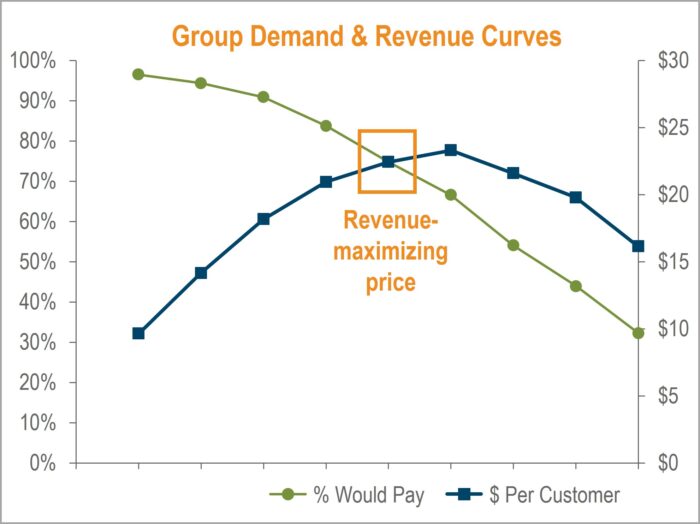

Gabor-Granger

Gabor-Granger is a market research technique to identify the highest point a customer is willing to pay. It asks participants how likely they are to purchase a given product or service at different price points until an optimal price point is revealed. The aggregated data plots demand and revenue curves to pinpoint the most a customer would pay that maximizes an organization’s revenue. Ultimately, this analysis reveals a willingness to pay and price sensitivity that can be leveraged in setting prices.

MaxDiff

MaxDiff analysis, not to be confused with Best-worst scaling, is a survey-based research technique used to quantify preferences. A MaxDiff question shows respondents a set of items, asking them to chose what is most and least important. When the results are displayed each item is scored, indicating the order of preference.

Van Westendorp

Van Westendorp’s Price Sensitivity Meter (PSM) is a survey-based market research technique for determining consumer price preferences. The assumption underlying PSM is that respondents can envision a pricing landscape and that price is an intrinsic measure of value or utility. Participants are asked four price-related questions, then evaluated as a series of four cumulative distributions, one for each question. When the results are tallied, price curves can be created, and a range of acceptable product prices can be determined.

How to Apply Price Sensitivity Learnings to Elevate Your Pricing Strategy

Leading companies have clarity on the strategic objectives they aim to drive through their pricing decisions (e.g., share growth, revenue growth, volume growth, profit growth) and the tradeoffs they are willing to make to achieve those objectives. This requires driving strategic clarity, modeling the specific product or service’s economics (e.g., the impacts on revenue, volume, and profit at various volume levels), and developing an elasticity estimate to answer questions such as: “What would you have to believe regarding the volume response for this action not to be a good idea?” and “How significant of a volume response should we expect there to be in response to such a change?” Decision-makers armed with these elements can reach a more targeted pricing decision and, once implemented, better guard against an overreaction to emerging outcomes.

There are countless considerations when developing a pricing strategy—cost, product offering & positioning, historical stats, competitive landscape, market conditions, customer profile, channels to market, etc. Businesses often rashly consider their costs or competition as primary inputs. While these both play an important role in price setting, the optimal pricing strategy for any business captures the true value of your product or service.

Customer price sensitivity reflects a customer’s perception of your value. By gauging the market and customer sentiments, especially in dynamic market shifts or uncertainty, your organization is better equipped to set and change prices that customers are willing to pay, appropriately capture your value, and maintain your margin or revenue goals.

Below are 3 ways to utilize price sensitivity to elevate your pricing strategy and strategic pricing decisions:

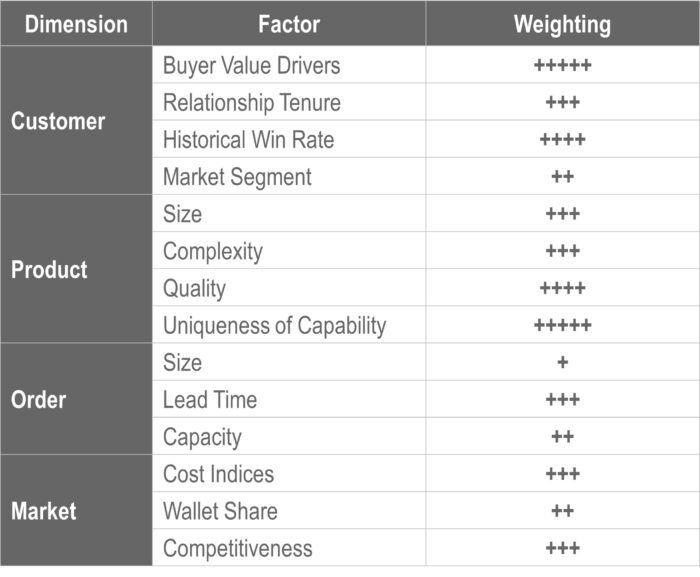

Deploy a pricing model that reflects price sensitivity

Learnings from a market study can reveal the factors most important to your customers when purchasing. These factors—quality, timeliness, customization, customer service, etc.—can become inputs in your pricing model to produce an optimal price recommendation. Your pricing model can also incorporate differences surfaced by customer types, such as region, size, or industry, for optimal, nuanced price segmentation by customer.

Additionally, factoring in price sensitivity when conducting price adjustments reduces risk. Often this is utilized as a multiplier in a differentiated price adjustment model to set target increase prices that reduce risk on certain customer groups that are more price sensitive.

Similar to maximizing profitability through product mix, businesses may benefit from optimizing mix from a willingness to pay perspective by focusing on customers and channels where price sensitivity is lower and/or willingness to pay is higher.

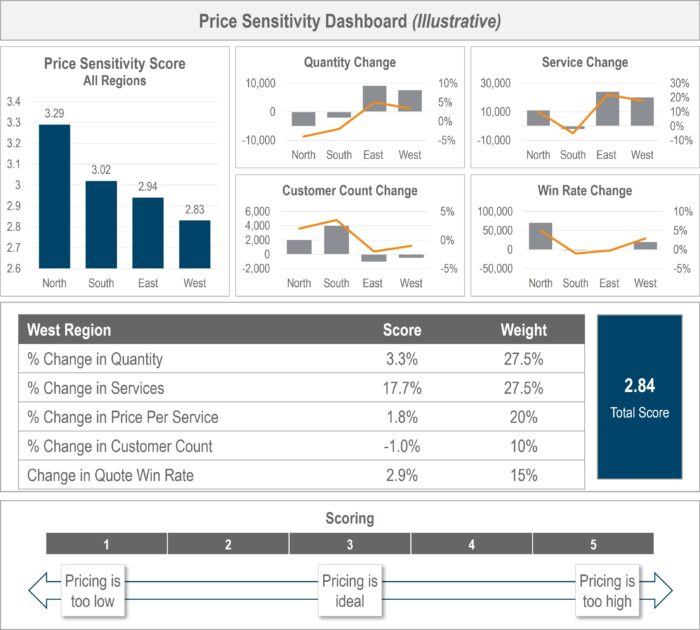

Implement price sensitivity reporting and analytics

Many of our clients benefit from implementing pricing analytics that capture and report trends that indicate changing levels of price sensitivity based on transactional and market data. These reports collect and deliver information that proactively triggers appropriate pricing action. Price sensitivity reporting follows four steps:

- Identify your organization’s unique KPIs related to market dynamics that influence price sensitivity

- Create an algorithm that scores those key KPIs to generate customer pricing health scores based on both transactional and market data

- Utilize analytics software to deliver front-end visualization of results at a set cadence, including opportunities to realign pricing to market conditions

- Implement an automated process to feed patterns and learnings back into the algorithm

Build consistent value messaging that adjusts for price sensitivity factors

Sometimes it’s not enough to internally align price to value. Customers often require unified, consistent messaging across your organization beyond just a price point. This surfaces through:

- Internal training on your organization’s value proposition

- Customer FAQs, such as value communication points that justify the why

- Customized customer letters or emails detailing pricing

- Sales scripts to combat concerns or pushback

- Escalation path to inform what you will accept and what you will not budge on in various scenarios

- Negotiation training

Optimize Results with INSIGHT2PROFIT

Understanding how your customers will react to your pricing is critical —but only the first step. Organizations must deploy that knowledge into a pricing strategy that produces optimized pricing for customers, that is dynamic enough to change with market conditions.

Example benefits of utilizing price sensitivity:

- Higher price realization

- Reduced volume risk when taking price changes

- Quickly and confidently respond to market changes

- Better forecast demand and price impact

If you are experiencing unwanted changes in demand, margin, or revenue, INSIGHT can help. Our data engineering and market intelligence capabilities uniquely position us to help quickly uncover the root cause of challenges your business is facing to answer your most important profitability questions. Then, we’ll turn that data into action to execute a customized price optimization solution for your business. Contact us to start maximizing profit today.