Retail Dynamic Pricing: How to Address Macroeconomic Volatility, Channel Complexity, and Competitive Landscapes

Retail, like most industries, has not been immune to cost headwinds stemming from pandemic-driven supply chain shortages over the last 2-3 years. Meanwhile, industry experts and Wall Street analysts are forecasting a reversal in price trends, suggesting that the industry will face deflation in the coming years. In addition, retailers that function as resellers are facing changes in consumer preference, spawning channel disruption, and disintermediation from online (e.g., Amazon) and direct-to-consumer models offering convenient shopping experiences at competitive prices.

Now more than ever, it’s critical for retailers to intentionally manage price as the industry faces uncertain and volatile cost change, higher interest rates, and channel / competitive complexity. Regardless of macroeconomic conditions, retailers will always need to offer market-relevant prices to sustain traffic and positive customer experiences required to profitably grow revenue and market share.

Leading retailers leverage dynamic pricing capabilities to manage price using a granular (i.e., product-location) and differentiated approach that systematically considers customer willingness-to-pay and present market / competitive pricing volatility. Dynamic pricing can scale in terms of price-change frequency based on what’s operationally feasible for each retailer – including daily price changes for online retailers, quarterly (or less frequent) for brick and mortar (BandM) retailers that require significant labor support to change price tags. Retailers that methodically capture and codify dynamic pricing’s key inputs into price management rules can optimize price in a swift and scalable way regardless of market conditions. When executed effectively, dynamic pricing offers a more prescient understanding for how to capture present market opportunities, and balances short-term profits and long-term market-share / growth.

Leading retailers have invested in dynamic pricing capabilities that have enabled swift and market-relevant price changes. The degree to which retailers can quickly address market changes to maximize financial impact largely depends on the degree to which they’ve invested in dynamic pricing and its underlying capabilities. Key questions on retail dynamic pricing:

- What is dynamic pricing? What are its goals?

- What inputs and capabilities are required to support dynamic pricing?

What is dynamic pricing? What are its goals?

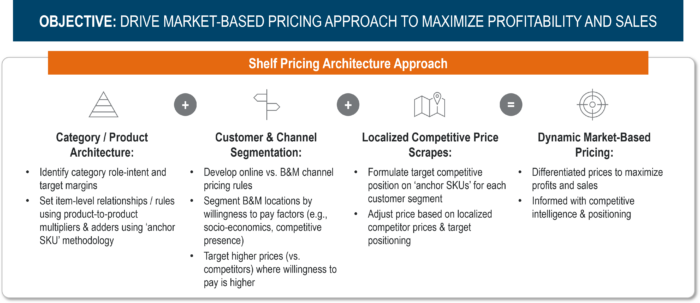

Dynamic pricing allows retailers to consider price changes based on present market conditions (i.e., demand, supply, competitor prices), willingness-to-pay, and codified pricing rules. Prices are adjusted based on observed market signals and willingness-to-pay factors captured in internal and external data sources, governed by rules and processes in price management solutions that automate and scale price changes. Leading retailers take a differentiated pricing approach by segmenting their business across product and location / channel dimensions to account for willingness-to-pay differences that are codified into rules and processes that automate price recommendations.

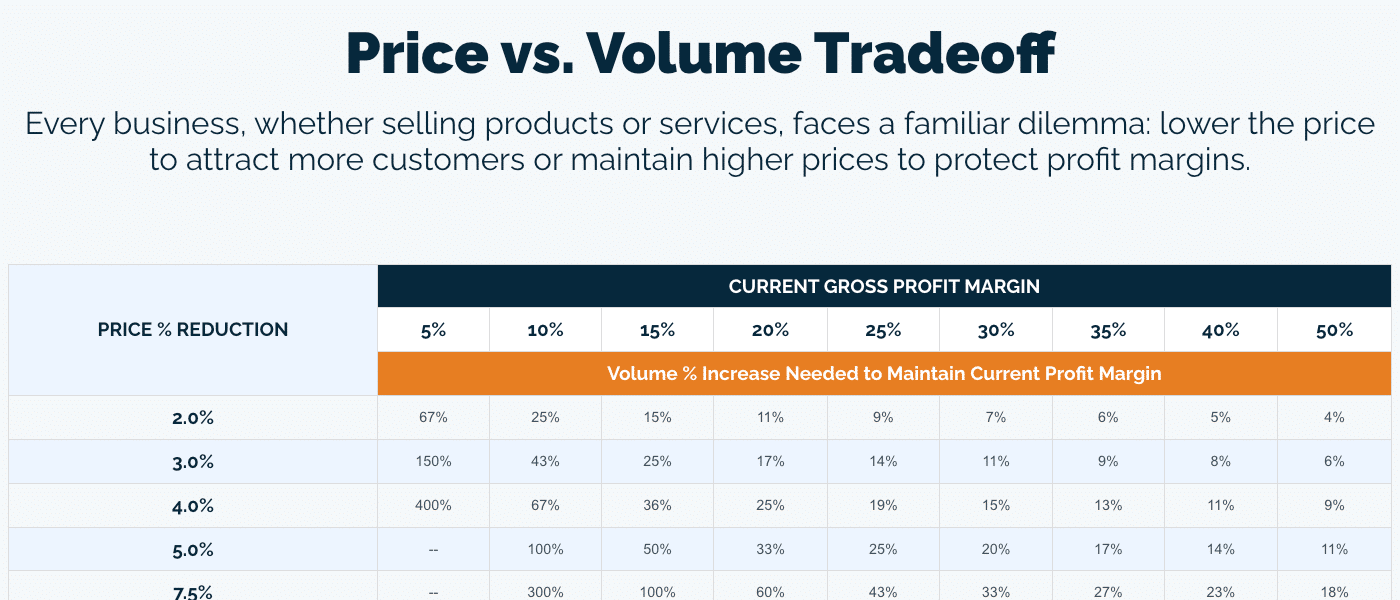

This approach allows retailers to automate and execute price changes that reflect real-time (or near real-time) market conditions and customer expectations. From a financial impact standpoint, dynamic pricing aims to preserve / extend margins while maximizing volume and transactions. Sales and margins can be optimized through differentiated pricing actions that consider granular competitive price changes and product / location willingness-to-pay factors. The ability to segment and differentiate price at granular levels allows retailers to maximize their market-share and profits by selling at higher prices where willingness-to-pay and competitor prices are higher and price lower where willingness-to-pay and competitor prices are lower.

What inputs and capabilities are required to support dynamic pricing?

Dynamic pricing requires a holistic set of capabilities to mechanically adjust and differentiate price across granular portfolio dimensions (i.e., product and location / channel). Leading retailers will combine the following data and analytical capabilities with transaction and inventory data to dynamically adjust prices.

Category / product architecture: Leading retailers know their customers. This includes understanding why customers buy from them (versus competitors) and which categories shape price perception. Leading retailers think of this in terms of category roles, which delineate categories according to price perception factors such as purchase intention and price sensitivity. For example – grocers intentionally price staples such as milk, bread, and produce at more competitive prices and lower margins than prepared foods because consumers are more conscience and sensitive to price on staple and commoditized categories. When retailers are not competitively priced on such categories and items, customers are more likely to switch to competitors offering lower prices. Remaining competitive on price-sensitive items is critical to driving store traffic, volume, and market share. Conversely, less price-sensitive and proprietary items are critical to driving margin and require less stringent / timely response to competitive price changes.

Within a category, leading retailers define and codify their line structures in price management solutions to enable swift pricing actions. This entails mapping items to one another to maintain logical price point differentiation that meet customer expectations. For example, if a gallon of milk is $3, then customers would likely expect a half-gallon priced near $1.50 (50% of the gallon). When the gallon of milk is raised, the half-gallon prices should increase by a similar %-rate to preserve the intended differential and psychological price points (e.g., maintaining prices below $5, $20, $100, etc.). Leading retailers codify these rules in price management tools to maintain logical price-point differentials and psychological price points, automate price changes, and prevent negative customer experiences.

Location and channel segmentation: Retailers with BandM operations span diverse geographical markets with differences in willingness-to-pay (e.g., high-income NYC Manhattan locations have a higher willingness-to-pay than low-income rural locations). Leading retailers will segment stores into zones based on willingness-to-pay factors such as house-hold income, home-value, and competitive-prevalence. Doing so allows retailers to capture higher prices and margins where willingness-to-pay is higher (e.g., higher house-hold income and home-values, less competitive prevalence) and lower prices and margins where willingness-to-pay is lower (e.g., lower house-hold income and home-values, more competitive prevalence). In addition, omnichannel retailers competing across BandM stores and online will set rules that govern BandM store and online prices according to customer expectations and channel economics. For example, retailers who offer 3rd party shopping through delivery apps (e.g., DoorDash, Instacart, etc.) will often set higher prices to account for customer-convenience and channel-specific delivery fees and costs.

Competitive price scrapes: Leading retailers track changes in competitive price points and incorporate such data into pricing decisions. This entails leveraging web scraping algorithms that capture competitor prices by product-location on a regular cadence. Competitive prices are even more valuable to the extent retailers ‘match’ competitor products and locations to their own. Doing so enables retailers to identify when competitors change price and the criticality to follow / maintain current prices according to a product-location’s target competitive price position, category role, and location / channel willingness-to-pay.

Many retailers will also evaluate the need to follow competitor price changes according to inventory / sales trends and financial objectives. When inventory positions are low and sales trends are outpacing forecasts, retailers may consider maintaining prices when competitors decrease price. Under the same inventory and sales conditions, a retailer may decide to follow competitors on price increases.

Getting Started with Retail Dynamic Pricing

There are a multitude of economic and market factors adding complexity to how retailers approach pricing, and these factors are often changing more quickly than businesses can manage. INSIGHT can help you identify the most appropriate pricing approach for your business, and then implement a solution that successfully navigates consumer and economic conditions. Dynamic pricing is imperative for long-term growth. Contact INSIGHT to learn how your business can earn more profits, grow market share, and develop best-in-class pricing capabilities.