Are your Payment Terms Still the Right Fit?

Building on our Price Leaks’ article, let’s talk about payment terms. You want to get paid promptly, so you have policies and incentives in place to encourage that. But have you taken a moment to consider whether your payment terms are the right fit for your business?

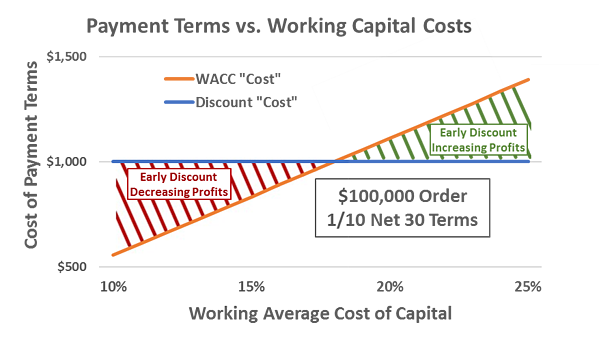

First, let’s consider your on-paper payment term policies. When was the last time you reviewed and updated your policies? What you want to consider is whether your payment terms – especially discounts offered for early payment – make sense for what your actual cost of capital is. Here’s an example for a $100,000 order on 1/10 net 30 terms; depending on your cost of capital, the early payment discount may be costing you profits!

Now that you’ve looked at how your payment terms are or aren’t working for you and identified profitable policies to put in place going forward, it’s time to dig into the data to see what’s actually happening on an individual transaction basis.

For example, do you know how often your customers are extending their payments beyond the stated terms? At a 12% cost of capital and 10% EBITDA, a 15-day payment delay is like losing 5% of your profits on the order.

Do you know how frequently you’re granting your customers an early payment discount even when they pay outside the discount window? At 10% EBITDA, allowing an unearned 2% payment discount costs 20% of your profits.

It’s important to quantify the costs of these unearned discounts and extended payments, and educate your sales team on the impact these lapses in policy enforcement have on them and the company’s bottom line. While it often seems easier in the moment to offer the customer a concession, those individual exceptions add up. Not only do they eat into your profitability, they also tie up your working capital and limit your ability to grow your business.

What practices could you adjust to stop price leaks like payment terms and have an immediate impact on your company’s profitability? Download our 50+ Most Common Price Leaks Infographic to identify other areas in which you might be leaving money on the table instead of putting it in your pocket.