Don’t Let Freight Hikes Drive Down Profit Margins | Manage Freight Costs

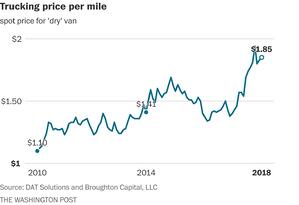

U.S. shipping costs have soared to unprecedented heights in 2018. While this indicator of a strong economy is good news for manufacturers on many levels, it comes at a price. In this case, approximately $1.85 per trucking mile — a 68% increase since 2010. What fuels this trend and how to manage freight costs?

A combination of high demand for trucks, low unemployment, and a fear by young Americans that self-driving trucks are the wave of the not-so-distant future has created a critical lack of truckers. The U.S. had a shortage of 36,000 truckers in 2016, and that number rose to 51,000 in 2017. Every indication is that number will continue its upward climb in 2018.

The impact of high shipping costs is not just limited to freight, either. Small parcel shippers like FedEx and UPS increased their average rates 4.9% in 2018, with some services seeing exponential price hikes. For example, additional handling for UPS shipments over 70 lbs. will see a rate hike of 75% in July, and the Over Maximum Limit surcharge is already up a whopping 233%! The USPS is experiencing its own stressors, as ePacket international pricing enables countries like China and South Korea to ship packages cheaper than can be shipped domestically, with those costs being passed on to domestic retailers and consumers.

This rise in shipping costs has had significant impact on manufacturers. Amazon implemented a 20% increase on the cost of Prime memberships. General Mills announced that the prices of cereals and snacks are going up as a direct result of rising shipping costs. John Deere is taking the same approach, and Walmart has identified high transportation costs as its “primary head wind.”

Since shipping has traditionally been one of the largest price leaks for companies, now more than ever is the time to identify and close these leaks in your pricing pipeline. Here are some key action steps you can take:

1. Assess Freight Loss Enablers

Shift Organizational Priority

Your value proposition to your customers includes both your products AND logistics, but the latter is often shunted aside in terms of focus and priority. The right product at your factory or warehouse location is of no use to the customer. Delivery of an empty box to the customer location would be equally useless. You cannot separate one from the other. Your customer depends on the right product at the right location at the right time. As such, logistics needs to gain equal priority in terms of organizational focus.

Get Educated

Because it is de-prioritized, often your freight transactions are opaque. Understanding transaction-level freight revenues and costs, both inbound and outbound, allows for intelligent freight management. Freight is margin eroding when your organization has not invested in necessary freight business intelligence (BI). Knowledge is power, and when it comes to freight that power is applied directly to the bottom line.

Address the “Amazon Effect”

As more customers become accustomed to fast, trackable and low-cost/no-cost shipments in their personal and business lives, it has reset expectations. They ask: What about free freight? Can I track my package step-by-step? Why not next day or two-day delivery at no extra cost? As these challenges increase, companies negotiate away more and more incremental margin on freight. Don’t reach for freight as the easy giveaway to customers, but instead engage in a healthy dialogue about what can and cannot be done to meet their needs while safeguarding profit margins.

2. Identify Opportunities

Increase Measurement and Visibility

Often some or most freight transactions are grouped into shared buckets. For instance, inbound warehouse freight charges might be understood at an aggregate level, but not for the individual items, suppliers, and carriers that are driving the headline figure. This makes it difficult to identify and act upon margin losing opportunities. Invest time and effort into allocating virtually all freight revenues and costs toward the relevant transaction-level business activities.

End Free Rides

When you pay freight on behalf of customers, within the narrow view of net freight only, you are losing money. It might be a sound commercial decision, such as for strategic customers. But you should ask the question and challenge the appropriateness of free freight. These situations are often ripe with opportunity. For instance, often we observe one or more outside sales staff who are responsible for a disproportional amount of free and discounted freight. Identify these outliers and implement consistent policies to bring them in line.

Stop Giving Away Unearned Benefits

Some freight policies that are favorable to customers are sound in theory, such as when a minimum order value or yearly spend is met. Customers are often offered such terms under the assumption of meeting such targets, but there is no check of delivering the freight benefit only when the target is achieved. This is the freight equivalent of allowing a customer to take 2%-Net 10 payment terms even when they pay in 60 days. Guppies enjoying whale treatment can be ripe for action. Take the time to confirm that benefits are being earned before rewarding customers with favorable freight terms.

3. Review and Adjust Profit Leaks

Premium Pricing for Premium Service

Exceptional customer service is a great basis to attract and retain customers. However, costs for value-added freight services should be passed through when possible, including:

- Expedited shipments

- Restricted delivery windows

- Special handling

- Inside deliveries

- Exceptional notification and/or tracking requirements

Develop Processes and Controls

Freight is a convenient option to reach for when trying to please or placate a customer. That means that it is overused when there are not clear policies and approval processes for free and discounted freight. Develop freight pricing guidelines that balance customer service, flexibility on the front lines to negotiate and act independently, and protection of company profits via processes and controls when acting outside of pre-determined boundaries.

Bring Laggards into Line

Once visibility to transaction level freight revenues and costs are achieved, it illuminates an acceptable range of outcomes at the item level, for individual customers, for salespersons, etc. Disproportionate drags on net freight costs become apparent and can spur action. For instance, if net freight is +0.5% of sales overall, a given customer or warehouse at -2.5% of sales should attract interest. By definition, an outlier is falling short of a standard that is achieved consistently elsewhere in the organization. That should give you confidence that a challenge or inquiry is justified.

Consider Minimum Order Fees

Surcharges below a minimum order size can be a method to compensate for the larger percentage cost of freight on smallish orders. This strategy is not applicable in all industries but holds promise where freight costs as a percentage of sales is relatively high or where there are operational and cost saving benefits to encourage larger orders.

The Bottom Line

Looking for more insights and an action plan regarding your customers’ outbound freight revenue and policies? INSIGHT2PROFIT uses its DRIVE technology as one tool to help clients understand all aspects of its profit-impacting activities, including freight. Contact us to find how we can put DRIVE to work for you today.