Exit Planning Q&A: The Secret Weapon for Private Equity to Maximize Transaction Value

M&A activity continued to decline in 2023, with deal values falling to their lowest point since 2017 except during pandemic-driven 2020, PitchBook reported in their 2023 US PE Breakdown. But with the upward momentum expected in 2024, companies are getting ready for an anticipated shift in the M&A market, volleying terms like “rebound” and “rally”. However, rising capital costs, market uncertainty, and other lingering macroeconomic factors are placing significant pressure on the M&A world. The need to return capital to LPs and increased demand for deals will drive activity, but buyers are placing magnifying glasses on sellers in order to lower their risk in a tighter, evolving economic environment. This has resulted in a growing need for companies to expand and innovate their exit planning approaches to maximize transaction value and preempt buy-side inquiries.

We sat down with Rebecca Monico, Director of Private Equity Data Solutions, to get her take on private equity exit planning in today’s market. Rebecca has over 15 years of experience supporting private equity firms and their portfolio companies with exit strategy planning and guidance. At INSIGHT, she leads the development and implementation of our sell-side solutions to our private equity clients.

1. What recent trends has INSIGHT seen with how private equity firms are approaching exit planning?

Over the last couple of years, there has been a notable shift in how and when private equity firms approach exit planning. Sale readiness has historically been viewed as a distinct, end-of-lifecycle phase that follows other growth and transformation initiatives. Now, we are seeing more frequently that exit planning begins as soon as a new deal has closed. This doesn’t necessarily mean PE firms are selling earlier—in fact, at the end of 2023, hold periods were the longest we’ve seen in 2 decades— but rather that there is significant value in approaching the exit planning process sooner, regardless of the overall length of the hold.

The key lesson learned from the market volatility over the last few years has been to expect the unexpected. Private equity firms would prefer to have their portfolio companies “on deck” for a sale if market conditions swing in their favor, rather than following a “by the book” timeline and gambling on the right market conditions in that window. Exit planning needs are often time intensive, and relying on the frenzied months leading up to the sale process can result in sub-optimal outcomes. Many PE firms have responded by building stronger exit planning playbooks that can be deployed at the onset of a purchase and leveraged throughout the hold period to ensure value creation goals are met and measurable.

2. What are you seeing in the market that has influenced how private equity firms are preparing for an exit?

Many businesses have been faced with a new set of challenges due to inflation subsiding. While overall costs have started to fall, inflation is still higher than the 2% target the Fed has set. For those that struggled to keep pace with the rapid rate of inflation, they are finding it difficult to grow or even recover margins to pre-inflationary levels.

A common theme related to the COVID-driven inflation pains was the unprecedented nature of the impact; businesses had never experienced that level and pace of change and did not have a plan in place or confidence in customers’ receptivity to price changes. Consequently, the tapering down that has followed brings its own set of uncertainties.

Past market conditions met with future uncertainty means many of our clients are unsure if the previous price increases are sustainable and if they can hold margin moving forward. We’ve noticed selling PE firms and investment bank partners have been intently focused on proving the sustainability of pricing while maintaining or growing volumes. If they can’t, it’s a double whammy to the sale process—you lose trust in what was gained, and you lose trust in what can be gained.

3. What are some of the biggest challenges sellers face when preparing to go to market?

The biggest challenge we see—and most often overlooked—is the data. We’ve seen firsthand how buyers’ questions can be the bane of a sale process. Having sale-ready data is the equivalent of having the answer key for a final exam and offers buyers a window into the business. Quality data enables robust and granular data analytics that prepare sellers to respond with the clarity and confidence buyers expect.

Often, businesses need to start gathering their data 12 to 18 months in advance of when they believe they may go to market. Getting a company’s data in a sale-ready state typically becomes more complicated than expected. Failure to do so means you can expect a much larger diligence request list from buyers and a slow turnaround from the seller that is likely to be more anecdotal than analytical. Selling companies risk undermining valuation objectives if they can’t prove what they believe to be true.

Quality data not only yields significant value long before the transaction, but also throughout the hold period. It’s such a critical aspect to success because data drives multiples—it provides an unmatched foundation for growth, both organic and inorganic.

Timing is another big piece of the puzzle. We’ve seen a lot of companies begin the process, and then market conditions or previously unknown business obstacles cause the transaction to stall.

Given the above, this means there are likely significant resources that will be tied up during this process. This is why we’ve seen PE firms build more purposeful exit planning strategies and playbooks that account for this critical period of the PE lifecycle.

4. How can businesses prepare for a sale when volatile market conditions limit visibility into exit timelines?

With exit timing more elusive, PE firms and their portfolio companies need to be nimble and ready to mobilize at the appropriate time without wasting resources. On the other side, they should be armed with continued value-generating initiatives should the sale occur later than initially anticipated.

It is critical to carefully assess, prioritize, and measure growth initiatives (i.e., value creation plan) early on and throughout the hold period. In the event that a sale occurs sooner than anticipated, the company is ideally already positioned for growth. And if it occurs later, the business is set up to track and measure performance over time—and quickly intercept any unexpected hurdles.

Private equity firms that initiate exit planning strategies earlier in the hold period are better positioned to capture and measure “quick wins” leading up to a sale. As an example, companies have successfully incorporated strategic pricing initiatives in the year prior to the sale, providing enough time to begin realizing impact while also demonstrating an incremental value generator for the next owner. Our clients have also found that the time spent standing up best-in-class systems of data and measurement reporting can pinpoint areas of stalling growth to remedy while also quantifying new value-creation opportunities across the hold period.

5. Why is strategic pricing so critical to exit planning and how can private equity leverage it to their benefit?

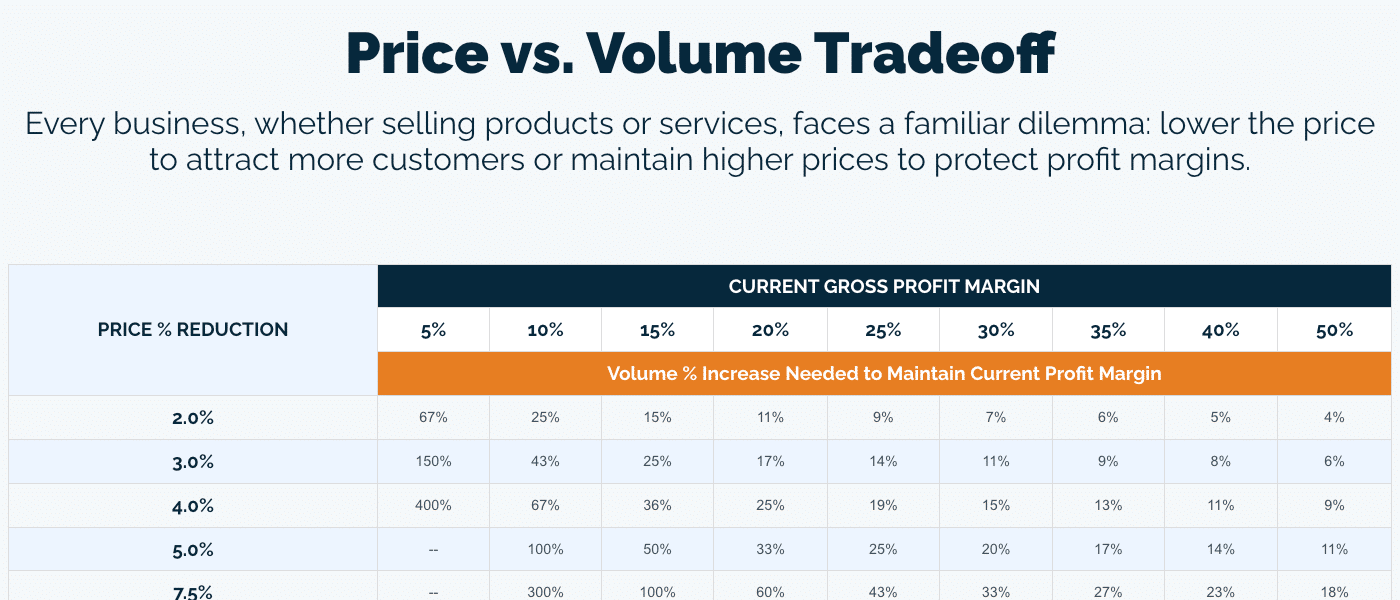

Given these conditions, strategic pricing, mix improvement, and cross-selling have all become critical requirements in exit planning. Specifically, the relationship between price and volume has captured a larger share of buy-side diligence efforts. Any gaps risk undermining credibility in expected organic growth opportunities and instill skepticism in the bridge between historical performance and future growth prospects. This means preempting buy-side requests and demonstrating the seller has already developed commercial capabilities is a pivotal success factor.

First, there is a strong value proposition in the ability to deliver measurable financial impact prior to selling. Implementing a pre-exit pricing initiative into the last mile of your hold period—typically considered 12-18 months in advance—can deliver financial results needed to realize value-creation plans. It also sets your business up for strong ROI by showcasing how you’ve successfully delivered tangible EBITDA impact, building buyer trust and conviction, while demonstrating a strong foundation for future growth initiatives.

But even without a last-mile pricing play, businesses would benefit significantly from a sell-side pricing due diligence assessment. These assessments can surface and bridge data gaps, anticipate buyer questions, tie storylines to specific datapoints, and prepare data and visuals for direct use. Additionally, a sell-side due diligence provides a clear roadmap of remaining opportunity and the underlying data to quantify the associated financial opportunity.

While strategic pricing is critical to exit planning, there are other organic growth initiatives that warrant attention. Mix improvement and cross-selling are two common examples that, when implemented, deliver compelling impact due to their ability to generate continued organic growth over time. While earlier implementation is ideal, there is at minimum significant impact in demonstrating and quantifying its future value-creation opportunity.

6. What are some other critical components to a successful exit?

INSIGHT has worked with hundreds of businesses—buyers and sellers—looking to complete a successful transaction. For sellers, one challenge is proving and getting credit for the value created, as well as the latent value yet to be created. Even when the seller feels they have a good story to tell, the buyers need to believe that opportunity exists, the organization is capable of implementation, and the financial impact can be realized.

Successful exits are the product of:

- A growth story that has “without a doubt” credibility

- Easy access to clean, functional data that underpins the EBITDA growth story

- Ability to confidently answer questions before they are asked

- A roadmap with a clear path forward and visibility to financial opportunity

These attributes validate worth, increase buyer conviction, and contribute to a smoother exit process.

7. Why are INSIGHT’s solutions critical to exit planning?

While private equity firms have placed increased emphasis on exit planning including dedicated resources and “re-diligencing” efforts, buyers have, in parallel, increased their scrutiny in evaluation of acquisition targets. As such, exit planning and sell-side transaction processes need to extend beyond data and analytics to truly tell the story of the business through insights—e.g., how the business has generated margin growth, how price differentiation across specific product categories and customer segments will drive margin growth.

INSIGHT’s exit planning and sell-side solutions are based on delivering more than $3B of margin impact to our clients over the last ten plus years. Further, INSIGHT’s significant experience collaborating with PE firms on buy-side diligence has informed our playbook for sell-side diligence and exit planning to ensure our clients know the answers to the questions buyers will ask.

We approach exit planning with a lens of developing capabilities (including data foundations) and defining and quantifying the improvement roadmap to prioritize initiatives based on ease and risk of implementation and financial impact. This level of preparedness and demonstration of strength of the commercial foundation of the business increases the certainty of close as buyers’ inquiries and concerns are addressed quickly.

Our solutions are deliberately structured to be leveraged across key stakeholder groups involved in a sale. We often work closely with management teams and deal and operating partners before an expected sale date has been determined, and once the sale process moves forward, we become close collaborators with the investment bank and other sell-side advisers to bring speed to their workstreams and improve deal execution.

Maximize Transaction Value with INSIGHT2PROFIT

INSIGHT partners with private equity firms to increase EBITDA impact throughout the hold cycle. Our exit planning solutions offer a differentiated approach to reduce risk, transact confidently, and deliver increased ROI. Contact INSIGHT to learn how we can optimize your near- and long-term exit plans and support your sale process.