Tackling Price Fatigue Head-On: A Guide to Strategic Pricing for Growth

We are hearing from our clients and partners that the market won’t accept higher prices. How, then, can businesses fulfill their growth plans? Now is not the time to press pause on strategic pricing, quite the opposite. While price fatigue may be a genuine concern, it warrants a more critical review to determine the optimal response for achieving your pricing and revenue goals.

The inflationary headwinds over the last couple of years have tested many companies’ ability to manage margin through volatile costs, price increases, volume shifts, competitive positioning, and customer perceptions. This has required a delicate, surgical response to strategically manage and optimize prices in order to meet growth plans.

Many businesses have successfully pushed through price increases to offset at least some of their rising costs. However, as inflation outlooks change yet again, how should businesses adjust their pricing strategy to manage growing price fatigue?

Use market intelligence to validate your instincts with facts

First, don’t let anecdotes, news headlines, or one-off customer statements dictate your pricing strategy. Reply on actual data from the market and your business results to cut through the questions and surface true facts about what’s happening with your customers, markets, and competitors. This is what your business should rely on when making pricing decisions.

Market research is fine, but it’s not enough. You need pricing insights that go beyond surface-level data, that delve deep into your customers, competitors, and the true drivers of value in your market.

Client spotlight – how one manufacturer turned a key customer’s price decrease request into margin growth

An industrial products manufacturer serving multiple end markets had an upcoming contract renewal with a large key customer. The manufacturer had not been able to adjust pricing as much as they needed to in the past few years due to contract terms, including the ability to pass through legitimate cost increases. Shortly prior to contract renewal, the customer requested a significant price decrease (~15%). Since this was a very important customer, our client was concerned. However, they also needed to address their margin decline due to contractual price terms that didn’t fully capture cost increases or value delivered.

A market intelligence study confirmed our client’s leadership position in the market.

- We interviewed one of our client’s main competitors and the customer’s distribution network to understand price trends, the value of the product supplied, and competitive alternatives.

- We found that our client’s customer had raised prices to the final end-users on the product our client supplied by 15-25%, despite minimal (<4%) prices increases from our client to the customer.

- We learned that the lead time to find a replacement product was 12-18 months and only one other supplier exists.

INSIGHT’s approach:

- Confirmed the appropriateness of a target price increase to the customer.

- Set a goal to drive $10M in EBITDA and developed pathways to achieve it via potential customer negotiation outcomes.

- Built a negotiation toolkit based on facts uncovered from the market intelligence study.

- Led onsite training to ensure buy-in and prepare our client for negotiations.

Price increases are not always the answer

Yes, they should be a part of every healthy pricing strategy. However, best-in-class pricing organizations do not only rely on price increases. This is for two reasons: 1) “business as usual” is a moving target, and 2) pricing excellence has so much more to offer. Companies that consider price increases as their only means to generate growth from price will never be as successful as those who utilize every revenue-generating aspect of strategic pricing. Simply put, you’re probably missing out on profit.

The first step we’d suggest is building a cost-to-serve waterfall. Many businesses struggle to understand the true profitability of their customers and products or services. This requires having transactional data, cost data, list price data, discount data, rebate data, promotional data, etc. readily available to extract and aggregate repeatedly. However, this data reveals where certain customers, products, services, regions, seasons, or other factors contribute to profit gains and losses. This visibility helps us craft tailored, targeted pricing plans for our clients to address the losses, close price leaks, and incrementally grow profits time after time.

Managing price leaks is an ongoing effort that is critical for profit management. It provides incremental profit in good times, and alternative ways to ensure growth in times of economic uncertainty.

The second step is price and policy adherence. You don’t necessarily need to change the price targets to the market; instead, be stricter around driving to the targets you have already set. This is one of the largest gaps in profits we see with our clients.

There’s probably more pricing opportunity in your business than you realize. Read 10 Signs There’s Pricing Opportunity in Your Business to surface unrealized pricing potential.

Drive margin growth with smart pricing programs

If margin growth is your goal, businesses can drive high-margin sales without necessarily changing price. Consider the following ways:

Mix Optimization

Certain products or services operate at a higher margin than others, and customer purchase patterns change. Encourage sales to promote certain products to certain customers by setting up commission structures, marketing campaigns, rebate programs, or loyalty programs that support these transactions.

Keep in mind a market intelligence study can help assess the validity of marketing and promotional programs and determine if your business can spend less while maintaining volume.

Cross-Sell, Upsell, & Bundling

Similarly, businesses can offer different or additional products or services to lower-margin customers. In this scenario, it’s essential to be strategic with your approach and offer items that the customer actually values. Machine learning algorithms can help identify historical patterns in customer behavior to better understand the best ways to nurture and grow your customers.

Read more about market-basket analysis and how machine learning (ML) can help drive revenue growth and customer lifetime value.

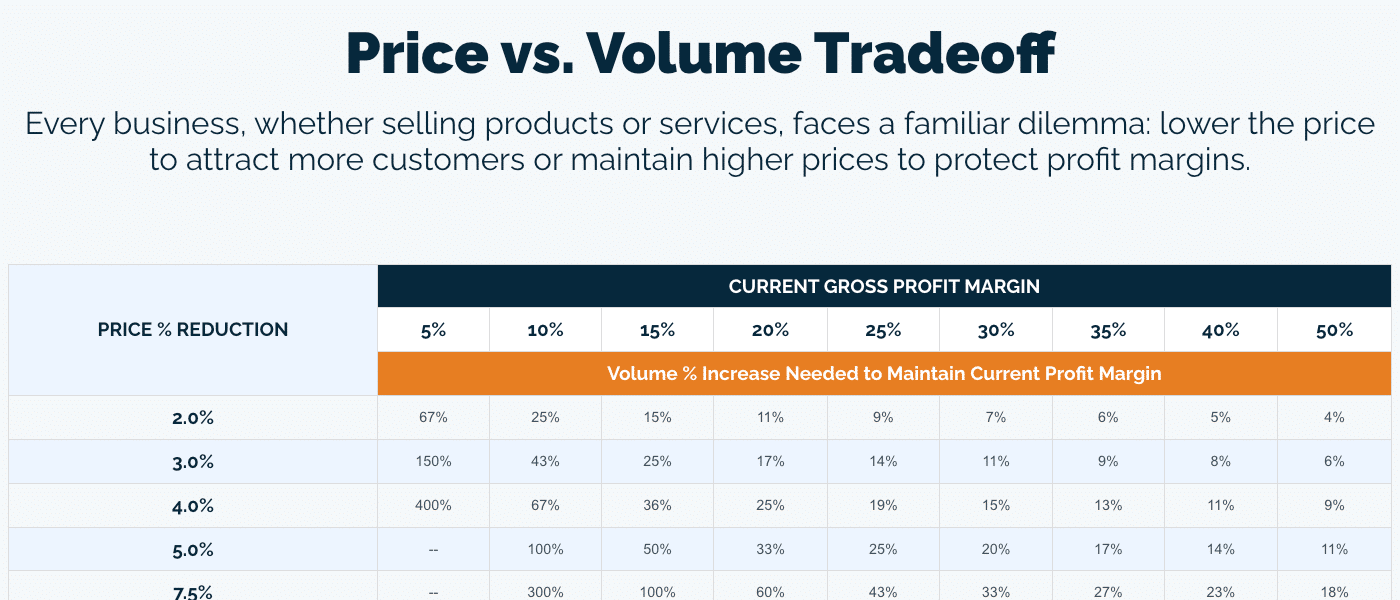

Beware of a “get the sale at all costs” mindset. While volume expansion is a worthy goal, companies can easily neglect the other factors in the margin equation, and it may backfire.

Lean into your value proposition

Price and value work hand in hand. You cannot simply continue to increase price to cover costs or expand margins without considering your customer and the value you provide them. While it may not be the intention, companies that reduce focus on their value promise inadvertently put revenue at risk.

Instead, conduct regular pricing health checks on your key customers. These can include:

- Awareness of financial data – e.g., margin or volume trends

- Macroeconomic factors affecting customer behavior

- Customer sentiments around your current pricing structure, programs, or terms

- Areas your customers find the most value

Understanding your customers’ circumstances is not only a sound business practice but also instrumental in refining your communication strategy when implementing price adjustments.

INSIGHT recently partnered with a billion-dollar business and consumer services provider who unexpectedly lost a significant number of customers. Over the last few years, this provider was committed to growth through strategic price and took advantage of the changing market to do so. Unfortunately, due to a variety of macro- and microeconomic and business factors, their quality declined, and their volume took a hit. This offset much of the growth they experienced and left them frustrated and behind the curve.

Even though price is a significant factor in generating growth, it does not stand alone. In times of fluctuating costs and price fatigue, it’s more important than ever to make sure your value proposition is clear, and you are delivering on it as expected. Then, when price increases are appropriate, you can stand by your value and turn a transactional cost line item into a relationship.

Tackle price fatigue with INSIGHT2PROFIT

Price fatigue is a reality; however, pricing plays such a significant role in growth that it can’t be ignored. If you believe your market won’t accept any more price changes, there are still opportunities to meet your growth plans. INSIGHT can work with you to first validate what the market sentiment truly is and then craft a tailored strategic pricing plan to help your business meet its profit goals. Contact INSIGHT to learn how to tackle price fatigue and implement pricing excellence in your business.