Unlocking Competitive Advantage: How Competitive Intelligence Fuels Strategic Pricing

Competitive intelligence is a specialized area of market research focused on gathering and analyzing competitor information and actions. In the context of strategic pricing, this extends beyond simply tracking competitor prices. It involves understanding their value propositions, strengths and weaknesses, customer perceptions, and more. Ultimately, it informs how your competitive landscape should shape your pricing and commercial strategies.

A comprehensive understanding of your competitive landscape is becoming increasingly fundamental for sustainable growth. Additionally, it becomes a critical differentiator in times of market volatility or uncertainty. However, it’s essential to approach competitive intelligence with a balanced perspective. This research should be applied strategically within the context of your organization’s unique circumstances and objectives to ensure it doesn’t inadvertently stifle growth initiatives.

With this in mind, how can your business strategically leverage competitive intelligence to fortify your pricing strategy and achieve a competitive edge?

How to leverage competitive intelligence across different industries and markets

Competitive intelligence serves as a valuable benchmark for market position, performance, and emerging trends. This knowledge enables organizations to refine their pricing strategies to be aligned with market realities, confidently navigate decisions based on evidence, and foster greater price realization.

Recognizing that pricing strategies are unique to each business, how competitive intelligence is employed will naturally vary across industries and market sectors. The most effective approach is tailored to the specific market dynamics and available data collection methodologies.

How transparent is price in your industry or market?

Price transparency plays a strong role in determining the best approach to gathering and utilizing competitive intelligence.

Pricing is quite transparent for B2C companies as well as B2B businesses with a D2C channel. These organizations can leverage a web scraping program to automatically pull prices and other relevant information, such as customer reviews, product descriptions, and inventory levels.

Pricing is typically more opaque for most B2B products and services, and some B2C (e.g., home services) companies. This can be due to factors such as:

- List prices aren’t communicated to the market outside of sales conversations

- Discounting is common and does not follow an easily identifiable rubric

- Products / services may be highly customized, resulting in variable price points

These organizations rely heavily on in-depth interviews and surveys with an appropriate sample size to gather information.

Can you develop apples-to-apples comparisons across key product/service characteristics?

Some industries, such as fast-moving consumer goods and aftermarket parts, are more commonly able to identify like-for-like comparisons between competitor offerings. This enables a more straightforward path toward understanding an organization’s competitive position in the marketplace.

Other industries face differing levels of variability in their offerings to customers. We see this frequently in SaaS businesses, where the mix of features and different pricing structures can make it challenging to get a true price comparison. For example, a competitor’s solution may be missing a feature that customers purchase separately from a third party and integrate into the competitor’s application. A comparative analysis would need to account for spend on this third-party app to have feature parity.

The role of competitive intelligence in strategic pricing

Competitive intelligence is most effective when it serves as one component of a comprehensive pricing strategy that is carefully considered within the context of your organization’s objectives and market offerings.

Market-based pricing, or selecting price points based on competitor pricing, is a widely adopted method for some businesses operating in price transparent, highly competitive markets with similar products/services. While this can be effective in certain situations, typically a more sustainable, profitable, and customer-centric approach can be achieved through value-based pricing. This type of pricing method utilizes competitive intelligence as one input to determine optimal pricing, with the ability to adjust the level of emphasis.

For some businesses or market conditions, there’s a natural tendency to prioritize competitive dominance to secure volume and market share. However, such reactive strategies can be risky without robust intelligence to guide decision-making. Overlooking the critical nuances of profitability, such as product mix or customer prioritization, can lead to unnecessary price reductions. Businesses need to stay armed with data-driven evidence that drives genuine profitability, rather than simply reacting to the disruption-of-the-day.

Given these complexities, actionable competitive intelligence often requires a nuanced and holistic approach, including areas such as:

- Collect voice-of-customer insights, either through interviews or surveys, to understand

- Customer key purchase criteria

- Perceptions of competitor’s performance on key purchase criteria vis-a-vis your business

- Perceptions of competitor’s price positioning relative to your business

- Stickiness of customer relationships and ease of switching suppliers

- Survey competitor’s customers to ask what they are currently paying, along with the context needed to interpret those prices (e.g., pricing structure, features included, discounts)

- Conduct channel research to collect price points, either via interviews with channel partners, or leveraging the salesforce to collect price points while in the field

- Scrape information in the public domain via ecommerce websites, competitor websites, investor relations documents, FOIA requests, etc.

- Run secret shopper programs to collect competitive quotes, along with insights into competitor sales processes and value messaging

Optimal competitive intelligence programs typically combine several of the approaches above to triangulate a comprehensive baseline of your business positioning in the market vis-a-vis competition. A common misconception of competitive intelligence as an input to a pricing strategy is that it is only valuable if you can get concrete data on competitor prices. But in most instances, it isn’t feasible to measure prices directly and, if you could, it only tells you part of the story. Understanding all the factors that go into a customer’s buying decisions and the value perceptions of different competitors is needed to take action.

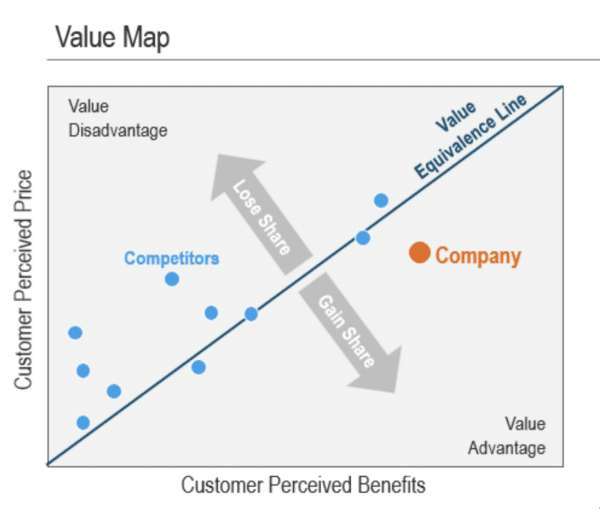

Market Intelligence inputs utilized to support value map analysis: Customer core value drivers and relative performance of competitors against those customer core value drivers

Additional competitive intelligence considerations and use cases

- Understanding market trends is also relevant in order to make decisions in the context of how the market is moving. It’s important to know if industry volume is the root cause of sales declines versus losing to competition.

- Outside of pricing decisions, competitive intelligence can support salesforce effectiveness and marketing. Knowing your competitors’ comparative strengths and weaknesses lets you develop talk tracks for effectively selling against them.

Competitive intelligence as a differentiator in strategic pricing

Maintaining consistent visibility into your competitive landscape helps ensure a strong, sustainable pricing strategy. In time of market uncertainty or volatility, this research provides a vital source of factual data, mitigating the risks of relying on intuition or anecdotal evidence. This leads to more informed, agile, and ultimately more profitable pricing decisions, enabling businesses to navigate change and uncertainty with greater resilience and confidence.

Tariffs and supply chain disruptions

Our recent guide, 4 Steps to Profitably Navigate Tariffs and Mitigate Impact, explains how market intelligence can give companies a strategic advantage in effectively navigating tariff-related challenges. Targeted market studies can answer critical questions that help businesses understand how their markets and competitors are affected by and responding to tariffs, guiding proactive strategies to mitigate negative impact.

Macroeconomic disruptions, such as tariffs, often present complexities that extend beyond the surface. For example, even businesses seemingly unaffected by tariffs or supply chain disruptions can benefit from competitive studies that reveal indirect supply chain exposure, or opportunities to expand margin or grow market share.

When organizations anticipate these types of wide-range cost fluctuations, competitive intelligence provides visibility to potential shifts in market position, and helps inform effective responses that balance market dynamics, customer sentiment, and organizational objectives.

Profitability, cost to serve, and price optimization

Pricing-related areas such as discounting, rebates, fees, freight, and other costs to serve all influence profitability as well as overall customer brand and price perception. Competitive intelligence studies can identify how your policies, product offerings, promotions, or other unique business factors compare to competitors and how that might be helping—or hurting—your business objectives.

This can include areas such as:

- How are my competitors bundling their products and services?

- How do my competitors package price?

- Is my quoting process too long or cumbersome versus competitors, and how important is this to my target customer?

- Am I offering too many or too few discounts to stay competitive?

- How does utilization or seasonality play a factor in pricing and discounting versus competitors?

- Is my sales team communicating price in-line with our positioning?

Effectively articulating your value to the market is crucial, especially during periods of uncertainty. Understanding how your customers perceive your complete offering, from price to experience, relative to competitors, drives successful strategic pricing and market decisions.

Competitive intelligence in action

Client Example: Consumer Products & Services, Recreational Products

- Objective: Client was experiencing weak volumes and was concerned that competitors had cut prices and taken share. We investigated competitive pricing for certain products versus the same research conducted 1 year ago to explore possible changes.

- Approach: Conducted secret shopper phone survey to distributors to gather pricing across 7 distinct products, excluding delivery and installation; Completed 40 interviews across 3 regions.

- Finding: Competitors had not decreased prices, which prevented Client from reactively cutting prices, ensuring they maintained margin.

- Price Comparison: Little difference in pricing levels between the 2023 and 2024 surveys

- Regions: Consistent pricing across regions

- Alternative Provider Products: Only 2 respondents identified alternative providers

- Discounts: Discounting is infrequent, and where occurred was based on purchase volumes

Client Example: Industrials, Utilities; Environmental Services

- Objective: Client was unsure if they were priced according to market factors and were looking to enhance profitability and potentially grow market share. We investigated core competitors in specific regions to understand their usage / capacity, pricing approach, contract structures, and customer decision process and switching behavior.

- Approach: Conducted in-depth qualitative interviews with customers/prospects (40) and competitors (5).

- Findings: Research provided fact-based details on how to position themselves with customers and the best areas to grow price based on the competitive landscape and customer values.

- Customers are more focused on availability, turnaround time, and quality than cost; emergency situations make price almost irrelevant

- Room to grow market share of certain products through enhanced bundling

- Implement a more dynamic pricing structure that reflects customer purchase values such as utilization and market conditions

Client Example: Distributor, Building Materials & Construction Products

- Objective: Client was seeing declining volumes and needed to understand if it was due to being priced uncompetitively or other factors. We investigated drivers of Client’s performance over the last year and key actions that the company can take.

- Approach: Conducted in-depth qualitative interviews with customers (15), voice of customer survey (174), and Sales Manager pricing survey to collect retail price points and competitive SKUs (227).

- Findings: While priced higher than competition, Client wasn’t losing sales as a result. Price positioning relative to competition hadn’t changed and volume softness was more tied to market conditions.

- Evidence that overall sales in this industry are down year-over-year

- Most respondents indicated prices stayed the same or increased slightly (+1-5%) in the last twelve months

- Consistently priced above competitors, which is reflected in overall perception in the market

- Most customers claim they’re performing the same as or better than competition, suggesting price positioning is not impacting share

Client Example: Consumer Products & Services, Durable Goods, Residential Services

- Objective: Assess existing pricing and commercial strategy to find growth opportunities and understand how they’re currently positioned versus competitors. We investigated the in-home sales process and competitors to determine pricing and discounting strategies, customer perception of Client and its sales experience, and sales rep behavior.

- Approach: Conducted secret shopper phone survey (60) across 5 regional markets.

- Findings: Client is a knowledgeable, trusted brand with aligned market pricing, however the sales process showed some gaps versus competitors as well as confusing discounting approaches.

- Client prices tend to be near or above average, with large variation in discount comparisons, signaling opportunity to redesign discounting programs and address sales rep behavior

- Shoppers received a fairly consistent experience, with communication (pre-visit message, quote timing, and follow-up) as an area of opportunity

- Client stood out from competitors by presenting more information and demos, and sellers consistently mentioned differentiating points

Competitive intelligence with INSIGHT2PROFIT

Competitive intelligence is a powerful tool that enables businesses to make informed pricing decisions, optimize pricing and commercial strategies, and navigate complex market dynamics. Whether you’re facing economic uncertainty or seeking to refine your pricing approach, INSIGHT2PROFIT can help you gather and analyze competitive intelligence to confidently position your business for success. Contact us to learn how you can leverage data-driven knowledge to create a winning strategy and embed a competitive advantage in your business.