How Current Economic Factors Are Impacting Profitability

Everyone is talking about the macroeconomic headwinds and recent geopolitical factors and what it could do to the economy. Around the globe, economic factors that used to be reliable are becoming increasingly unstable. For example, inflation has hit a record high, and in response, multiple central banks are either considering or already implementing interest rate hikes. If left unchecked, inflation and rising interest rates can directly and indirectly wreak havoc on your business operations, staff, and revenue.

No one can hide from the economic impact of unprecedented global turmoil. People, businesses, and even Private Equity Firms must be aware and adjust their operations and investing strategies accordingly to maintain momentum when interest rates, inflation, and other economic indicators rise and fall.

We sat down with Chief Growth Officer, Terry Oblander, to get his take on how current economic factors are impacting profitability. As one of the founding team members of INSIGHT2PROFIT, Terry has led over 100 pricing and profitability improvement engagements and helped companies achieve over $300M incremental EBITDA. Throughout his career, Terry has garnered valuable insight and expertise when it comes to navigating and remaining profitable during times of unpredictable economic uncertainty.

What economic factors are affecting profitability right now?

Terry: We are living in very interesting times. Inflation is at a 30-year high. There is a strong consumer demand coupled with a fragile global supply chain consistently being tested. The Fed is raising interest rates to slow down inflation, but there are concerns about it pushing us into a recession. There is geopolitical unrest with the war in Ukraine and Russia, putting many things into flux. There are headlines related to potential food shortages on the horizon. It’s enough to make any executive question their forecasts and profitability. With all that said, it becomes imperative that leadership teams understand their profitability and examine the rules of engagement with their customers.

How does inflation affect a company’s bottom line? Should companies be worried about increasing interest rates?

Terry: Inflation rears its head in many ways in a business: it costs more to buy raw materials to make products, it costs more to retain and recruit new talent, it costs more to deliver products to customers with spikes in fuel costs, it costs more to travel to see clients, it costs more to borrow money that can be deployed to grow new markets, expand production, or strategically acquire new services. It’s critical that a leadership team knows where its money is going and understands and projects the impact of these factors to plan to get ahead of it.

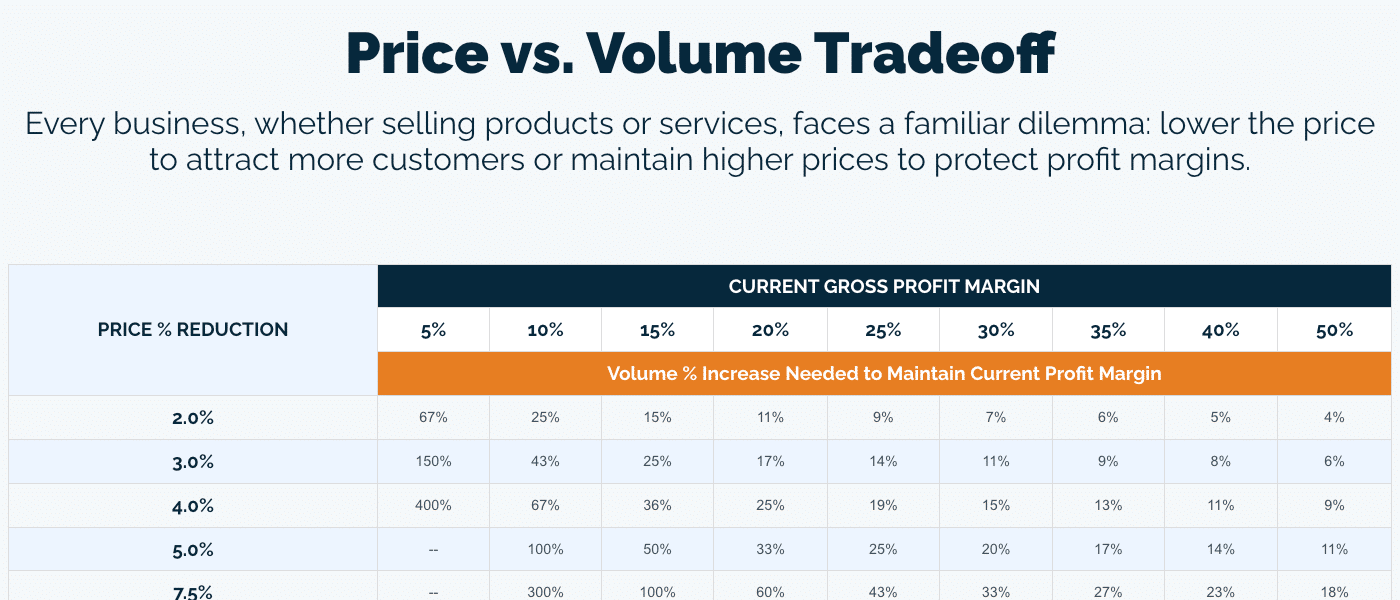

Speed to action is one of the most common areas we see companies leaving money on the table. Every month where cost increases are not offset is a profit leakage that you can never fully recover. Imagine that your fuel costs are going up – at the pump, via aviation, and higher shipping costs. Suppose you’re an organization with a standard freight policy or levels at which you provide free shipping. In that case, your costs are going up and the longer you wait to update that policy to reflect the new cost base that you’re incurring, the less profit you’re going to make.

Same story with raw materials. Let’s assume you receive a letter from a supplier saying they’re raising their prices (your costs) by 5% and that it takes effect immediately. The longer you wait to roll that out to your customers, the more of the impact is felt and absorbed directly by your business

How can companies better prepare themselves to weather a changing economy?

Terry: Right now, it is a great time for companies to take stock of their commercial programs and evaluate how they are incentivizing customers. The balance of power between supplier and company has changed, as has the purchasing decision-making criteria. Historically, “Price” would have always topped the list of most important factors. Now, “Availability” is the highest on the list. Companies should be looking to understand:

- Where do I create the most value for customers?

- Promotional Activities – Are they needed?

- Rebates Programs – With prices going up, are your rebates driving growth?

- Discounts & Price Exceptions – Do I need to be doing this in this market?

- Freight Costs – How am I doing at recovering my costs? Is this a ‘profit’ center?

- Quoting – Am I capturing and managing cost for price quotes based on ‘future costs’ as opposed to ‘historical costs’?

Pricing and profit growth in a volatile market is never easy. With the right strategy, tools, and approach, however, businesses can turn what appears to be a poor market situation into greater profitability and improved market positioning in the long-term. Quick win activities and long-term strategic plays can be done to offset existing roadblocks and lower your risks during any future volatility.

How does inflation affect a Private Equity Firm’s investment activities?

Terry: Two trends that I’d point to right now in the Private Equity space are:

- Private Equity multiples have continued to rise over the past few years. They are still lower than Public Markets but have grown steadily over time. This creates a more competitive space where businesses are sold at higher valuations. It also makes it more expensive to acquire a company.

- While historically record low, interest rates are now rising, which squeezes profitability for both the company and the sponsor.

Both of these events are putting a greater focus on value creation. They have led Private Equity Firms to invest heavier in Operating Teams and explore partnerships with specialized consultants to drive incremental value through value creation programs such as price optimization.

What should Private Equity Firms keep in mind when evaluating new investment opportunities?

Terry: Economic factors like inflation, war, and unstable interest rates force companies to operate in a constant state of flux. There are, however, ways to minimize the impact of these changes to your bottom line. In essence, it boils down to clarity and insight.

In today’s competitive landscape, it’s more important than ever for those considering an investment or acquisition to gain visibility into a target company’s potential growth opportunities and risks before the investment is made. INSIGHT2PROFIT’s Quality of Pricing® assessment utilizes proprietary technology and data analytics to provide clarity and confidence throughout the transaction process through a comprehensive and quantifiable pricing opportunity assessment, showcasing items such as:

- Discovering price differentiators

- Uncovering hidden price leaks

- Correcting price outliers

- Assessing wallet share opportunities

- Evaluating customer churn

- Identifying segmentation opportunities

This Buy Side Diligence offering identifies and quantifies EBITDA growth opportunities in a matter of days, bringing speed to clarity on value creation opportunities in the pricing and profitability space.

Increase Profitability with INSIGHT2PROFIT

When businesses partner with profit consultants like INSIGHT, they identify the potential impact of external economic factors and eliminate business unknowns. To learn more about INSIGHT2PROFIT’s strategic pricing and profitability services to help you navigate the current economic environment, schedule a time to talk to one of our senior advisors. Together, we can define the road to increased profitability and continuous improvement.