Unlocking Profit Potential: Mastering Customer Rebates for Strategic Growth

In many businesses, customer rebates often result in profit leakage and fall short of achieving their intended strategic goals. Rebates should be considered as one key element of a customer’s overall profitability picture and not, as is often the case, as something separate. The encouraging aspect is that pricing teams can exert substantial influence on this aspect of the price structure by fostering cross-functional collaboration and employing straightforward analytics. This post will address common challenges in rebate design and implementation and provide tactical recommendations for improvement at your company.

Implement a Standardized Rebate Agreement Template

A first step in moving your rebate strategy to the next level is to align cross-functionally on a standardized template for all rebate agreements. This not only facilitates easy comparison of agreements with various customers but also streamlines both the accrual and payout processes for the finance team. Additionally, it reduces the time legal spends reviewing and potentially drafting multiple agreement versions. While it may not be possible to transition all customer agreements to the template in a single negotiation cycle, and exceptions may be warranted, having a standard template serves as a valuable benchmark.

Here are some key components that have proven effective in a standard rebate agreement template:

Total Spend Threshold

Including a total spend threshold amount, often equal to the customer’s annual budgeted sales, helps foster alignment both internally and externally. Failure to meet this threshold could result in either a 0% payout or a reduced amount compared to what would be earned based on the payout tiers.

Discrete Payout Tiers (Non-Resetting)

It is a best practice to have discrete payout tiers where the maximum rebate percentage a customer qualifies for is not applied to the entire spending amount. This approach minimizes risk and provides flexibility to offer a generous incentive for genuine growth, often aligned with the strategic objectives of the rebate, without causing significant payout fluctuations with each tier achievement.

Revenue Qualification

While late payments can be factored into the total spend threshold calculation, we’ve observed significant improvements in Days Sales Outstanding (DSO) by excluding invoices that are not paid on time from rebate payout eligibility. This option serves as an incentive for timely payments without requiring additional effort from the collections department and can be a compelling reason to offer a rebate agreement to customers with a history of delayed payments.

It is also important to include clear language that outlines other revenue types that should be excluded from the payout calculation. Examples here include returns, cash discounts, and other off-invoice savings.

Inflation-Adjusted Framework

Incorporate language, particularly in longer-term agreements, permitting adjustments based on cost and currency inflation. If the goal of the agreement is to promote and incentivize growth, it’s crucial to ensure that genuine growth is accurately measured.

Establish a Standardized Review Process

Establishing a standardized cross-functional review process is pivotal in maintaining the ongoing alignment of all rebates within the business strategy over time. Here are some key attributes and strategies for a successful review process:

Review Meeting Structure and Timing

Plan a meeting that enables comprehensive discussion and alignment on all customer rebates. Attendees at this meeting should comprise senior leaders from Sales, Marketing, Finance, and Product Management, as deemed necessary. Each sales team account owner and their manager should be granted approximately 10 minutes to present their proposed rebate agreement to the leadership panel for feedback and approval. Ideally, this meeting should be scheduled 2-3 months before the rebate’s commencement date, allowing ample time for presentation and negotiation with the customer to secure signature.

Pricing Team Responsibilities

The pricing team is usually well-positioned within the organization to facilitate this cross-functional process. Their role includes encompasses the following:

- Collaborating to develop a standardized PowerPoint template and partnering with the sales team to populate it for every customer rebate under review

- Scheduling and facilitating the review meetings

- Documenting all decisions made during the process

- Completing each rebate agreement template for presentation to the customer

- Managing the filing and sharing of all signed agreements as they are finalized

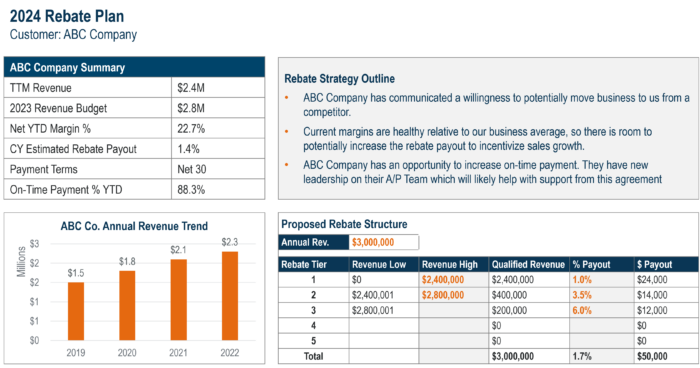

Below, you’ll find an example of a typical rebate plan review template:

Quarterly Performance Review

Maintaining a quarterly schedule for reviewing rebate performance is often beneficial. This cadence ensures ongoing awareness of whether the rebates are aligning with their strategic objectives and keeps them at the forefront of everyone’s minds throughout the year. If your organization already has a regular account review process in place, integrating a rebate performance assessment for all relevant customers can be a valuable option.

Ensure Your Team is Incentivized

Finally, it is also important to consider how your rebate plans align with employee incentives. We’ve observed instances where a commission structure based on gross margins can inadvertently incentivize shifting price discounts into rebates, as these adjustments don’t impact commission payouts. While this isn’t always problematic, it’s something to be mindful of when developing your rebate strategy.

How to Use Customer Rebates to Generate Growth

When managed through a disciplined and structured process, customer rebates can serve as a potential tool to drive business strategy. Rebates can serve as a less transparent method of discounting which will never show up on an invoice and end up in the wrong hands. Customers also often request immediate price reductions with the promise of future growth, which may or may not materialize. Having a standardized approach in place makes it easier to implement rebates when they make sense, addressing customer concerns while preserving margins if the promised growth doesn’t occur.

On the flip side, when your customer rebate plan doesn’t have a clear structure and strategy, it often results in profit leakage. Rebates should be considered a part of a customer’s overall profitability because they directly affect your organization’s bottom line. If you’re uncertain where to start, INSIGHT has the expertise and tools to identify where your customer rebates may be dragging down your profitability. Then, we can partner with you to design and implement a strategy that aligns with your business goals and generates strategic growth.

Contact INSIGHT to get started on the path to increased profitability.