Mastering the Art of Pricing: How Private Equity Can Maximize Valuation

Private equity firms operate in a highly dynamic and competitive landscape, where they serve as both the steady hand and the coach for unlocking value creation opportunities that drive the greatest ROI. Amidst the array of value creation levers at a company’s disposal, pricing stands out as one of the most powerful catalysts for strategic change.

In this blog post, we will discuss how pricing can present a unique—and often largely untapped—opportunity for private equity firms to maximize the valuation of their portfolio companies. We will also address the key challenges private equity firms face when pursuing pricing initiatives.

Why is Pricing a Key Value Creation Opportunity?

While the concept of pricing is relatively well understood, the realization that pricing is a linchpin for value creation is not yet universal among private equity firms and management teams.

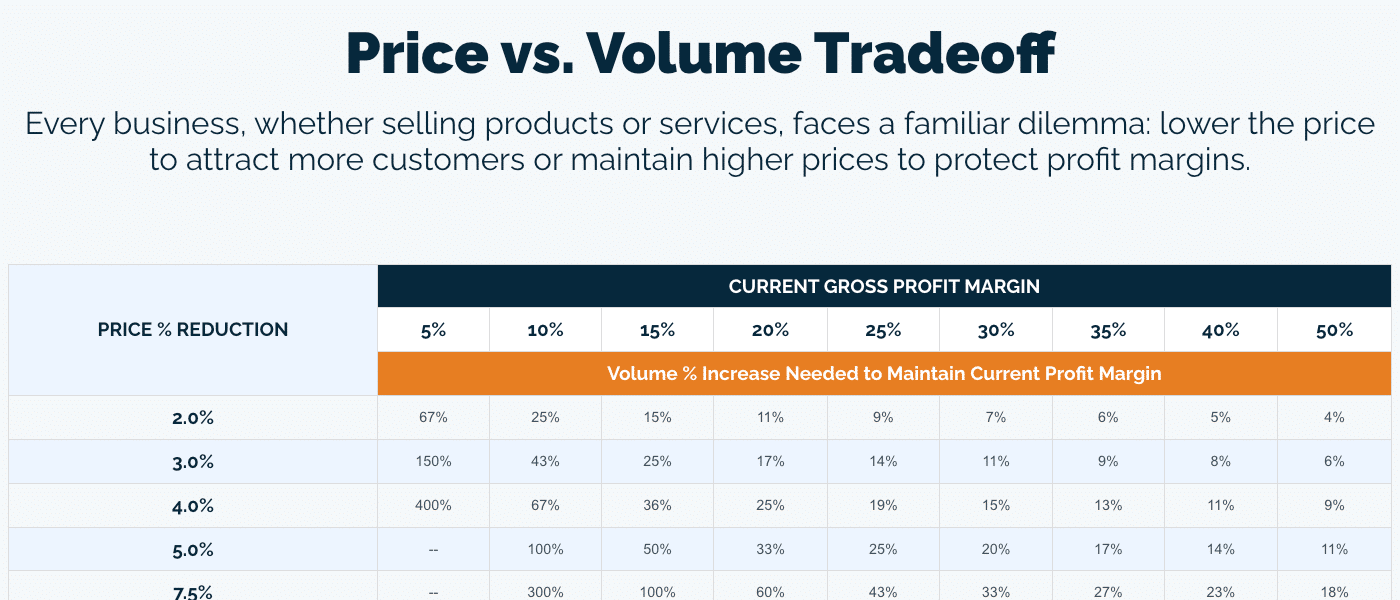

When strategically employed, pricing has the power to directly impact a company’s bottom line growth in a variety of ways. Extending far beyond the simple act of establishing a price, it’s about deeply understanding and aligning with customer perceptions of value, adapting to ever-evolving market dynamics, and, ultimately, positioning a business for sustained growth over the long run. This requires private equity firms to move beyond acknowledging pricing as a strategic lever and, instead, actively integrating it into their value creation strategies.

Business Attributes That Drive Value Creation Through Pricing

The inherent power of pricing lies in its ability to enhance profitability and position portfolio companies for long-term success. The businesses that derive the greatest value from pricing opportunities share several common attributes that tend to set them apart:

- Customer-Centricity: The ability to understand the intrinsic value that a product or service delivers to a company’s customers is the cornerstone of an effective pricing strategy. This requires ongoing market research, customer feedback analyses, and an unwavering commitment to aligning business prices with customer perceptions of value.

- Value-Based Pricing: Centered around a clear understanding and communication of unique value propositions, value-based pricing is another key attribute. Businesses that can quantify and effectively convey the value they provide to customers are better positioned to justify premium pricing models, which further enhances their overall profitability.

- Adaptability: In a rapidly changing business environment, static pricing models can often fall short. Portfolio companies that embrace dynamic pricing models will be much better positioned to effectively respond to changes in customer demand, competition, and market conditions. This adaptability ensures that those companies remain highly agile and competitive.

- Operational Efficiency: Operational efficiency and cost-awareness pricing are also important. The ability to effectively collaborate with a company’s operating team to identify cost-saving measures—such as vendor negotiations— without necessarily passing the gains on can translate into competitive pricing is a key aspect of a successful pricing strategy.

- Ability to Cross-Sell & Upsell: Recognizing cross-selling and upselling opportunities further enhances value creation. By bundling complementary products or services, portfolio companies drive revenue growth and deepen customer relationships. This requires robust salesforce effectiveness strategies and tools.

How to Leverage Pricing Opportunities in Private Equity

Identifying pricing opportunities that will increase a firm’s ROI requires a highly systematic and collaborative approach. While greater operational efficiencies can ultimately result in more competitive pricing models, this alone isn’t enough and must be accompanied by compelling pricing strategies.

One of the most high-impact tactics is for firms to establish a pricing center of excellence, which helps to centralize pricing decisions through a pricing organization design that employs the right people, processes, and tools to meet business needs. It encompasses three main functions:

- People: Leverage the pricing organization design to hire and retain top talent as well as define roles and responsibilities.

- Processes: Institute pricing processes that support ongoing salesforce effectiveness, drive accountability, and facilitate continuous improvement.

- Tools: Deploy pricing software and data analytics that enable smart, nimble decision making.

This underscores the importance of tapping into the full potential of a company’s data analytics capabilities, which often involves translating raw and complex data into clear, meaningful business insights that can shed light on emerging market shifts and provide a reliable feedback loop on results in real-time. This is truly invaluable to best-in-class strategic pricing, as this level of data empowers businesses to identify more pricing opportunities and, ultimately, drive greater value creation.

Through the use of advanced and AI-driven pricing tools, portfolio companies can quickly analyze large volumes of data based on historical transactions, customer segmentation, and market trends. This allows them to identify pricing patterns (such as in market basket analysis), forecast demand, and adjust the prices of their products/services in real time through a dynamic price model to maximize profitability.

Market research initiatives can also help firms identify pricing opportunities by revealing insights into current market trends, customer behavior, and competitive landscapes. Analyzing this feedback is equally crucial to align pricing strategies with customer expectations.

Driving Value Creation Through Pricing Poses Challenges

There are several key challenges often faced by private equity firms that seek to identify and leverage different pricing opportunities with the goal of driving greater value creation within their portfolio companies. Let’s explore each of those challenges and how to address them:

- Awareness of Pricing Potential: Many businesses may not fully grasp the potential of pricing as a value creation tool. Private equity firms can implement targeted educational initiatives to raise greater awareness among key stakeholders. Workshops, training programs, and case studies are all great ways to help demystify the role of price in profitability.

- Integration into Due Diligence: Pricing considerations may not be fully integrated into the due diligence process. This can be addressed by having due diligence protocols explicitly include a comprehensive assessment of pricing strategies and opportunity sizing, thus ensuring that pricing is duly considered from the initial stages of investment evaluation—whether you are the buyer or the seller.

- Agile Adoption of Technology: A company’s reluctance to adopt the latest technology may hinder the implementation of dynamic pricing models. It’s crucial that private equity firms advocate for the agile adoption of technology solutions that facilitate real-time adjustments to pricing strategies. This can be achieved by showcasing success stories where technology-driven pricing initiatives have yielded positive results for profitability and customer satisfaction.

- Strategic Alignment: Pricing may not be strategically aligned with broader business goals. A pricing center of excellence equips portfolio companies with the right people, processes, and tools to govern pricing decisions and meet business needs most effectively. This ensures pricing decisions are aligned with the overarching vision and mission of each portfolio company.

By overcoming these challenges and successfully integrating pricing into the core of their value creation strategies, private equity firms can maximize the latent value of their portfolio companies.

Pricing Opportunities That Can Yield “Quick Wins”

While some businesses may be eager to kick off a pricing strategy, others may benefit from seeing “quick wins”—or returns on their investment—early on in the partnership to demonstrate the tangible gains that pricing can deliver investing into other business areas.

A huge benefit of these quick wins is that they are often relatively low risk and easy to implement, yet they still offer great returns. Examples include:

- Correct sizeable price outliers, which includes customers who are receiving pricing that is starkly outside of acceptable ranges

- Enhancements to sales dashboards and targeted KPIs, which can provide greater visibility into customer behavior and preferences to identify new growth opportunities

- Potential gaps in discount management, such as areas where customers may be receiving unearned discounts on their products and/or services

- Policy changes to freight or payment terms that are actively losing revenue

A pricing opportunity assessment can quantify just how much untapped value is living within your portfolio.

More foundational quick wins involve optimizing operational efficiencies across a firm and its portfolio companies, such as by streamlining supply chains, improving production processes, and cultivating strategic vendor relationships. This quickly reduces operational costs, which boosts profitability.

Crafting a Measurable & Sustainable Value Creation Plan

Developing a value creation plan that is centered around pricing demands a measurable and sustainable approach. To facilitate this, private equity firms should actively collaborate with their portfolio companies to implement customer-centric pricing strategies catered to each business.

Following weeks of in-depth planning sessions and insightful conversations with industry-leading business executives, we recently identified key market trends that can maximize margin growth. Plus, by leveraging the right technology for dynamic pricing models and data-driven decision-making, portfolio companies will be better equipped to readily adapt and respond to market shifts.

The ability to quantify and communicate unique value propositions is crucial to justifying premium pricing and fostering long-term customer relationships. This involves a strategic blend of marketing strategy, customer communications, and a commitment to consistently deliver on that promised value. While often not quick to execute, these programs maximize revenue and lay the foundation for stronger customer relationships over the long run.

Sustainability is also a cornerstone, given the direct correlation between a portfolio company’s financial gains and its overall valuation. As such, firms should prioritize long-term pricing strategies over short-term gains. This requires fostering a culture of continuous improvement, where pricing strategies and processes are regularly reassessed, refined, and aligned with ever-evolving market dynamics.

Effective change management should not be overlooked either, as it ensures a seamless integration of new pricing strategies into existing operations. While upgraded pricing models can often require organizational shifts, change management helps mitigate resistance by fostering a culture that will be receptive to pricing changes. This enables firms to enhance the adoption and sustainability of pricing initiatives, ultimately driving greater value creation throughout their portfolio companies.

Sustainable pricing practices not only protect financial gains but also build organizational resilience, setting portfolio companies up for years of sustained success.

Maximize Your Exit Valuation with INSIGHT2PROFIT

Private equity firms need robust, repeatable, and dynamic growth programs to create unparalleled value. Pricing offers a unique path toward enhanced profitability and long-term success, but only if its potential is recognized.

Contact INSIGHT to learn how strategic pricing can enhance your valuation.