Law Firm

Strategic, Market-Based Rate Setting to Drive Profit Growth

Consistent, Market-Based Rates and Billing Process

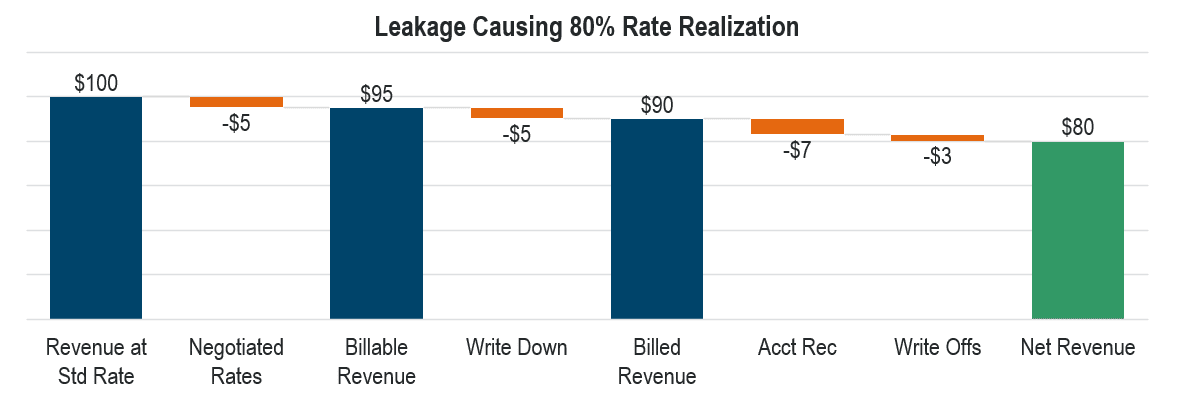

Maximizing realization from quote to cash

This law firm was facing significant challenges around market pricing, realization, and significant discounting occurring across roles, practices, and locations. There was a growing concern around how to increase realization and ensure pricing was in-line with market expectations and the company’s value. To address these challenges, INSIGHT developed a strategic pricing plan based on robust internal and external data to drive sustainable change across the organization through rate setting, realization, and the cash collection process.

Explore More Case Studies

Situation

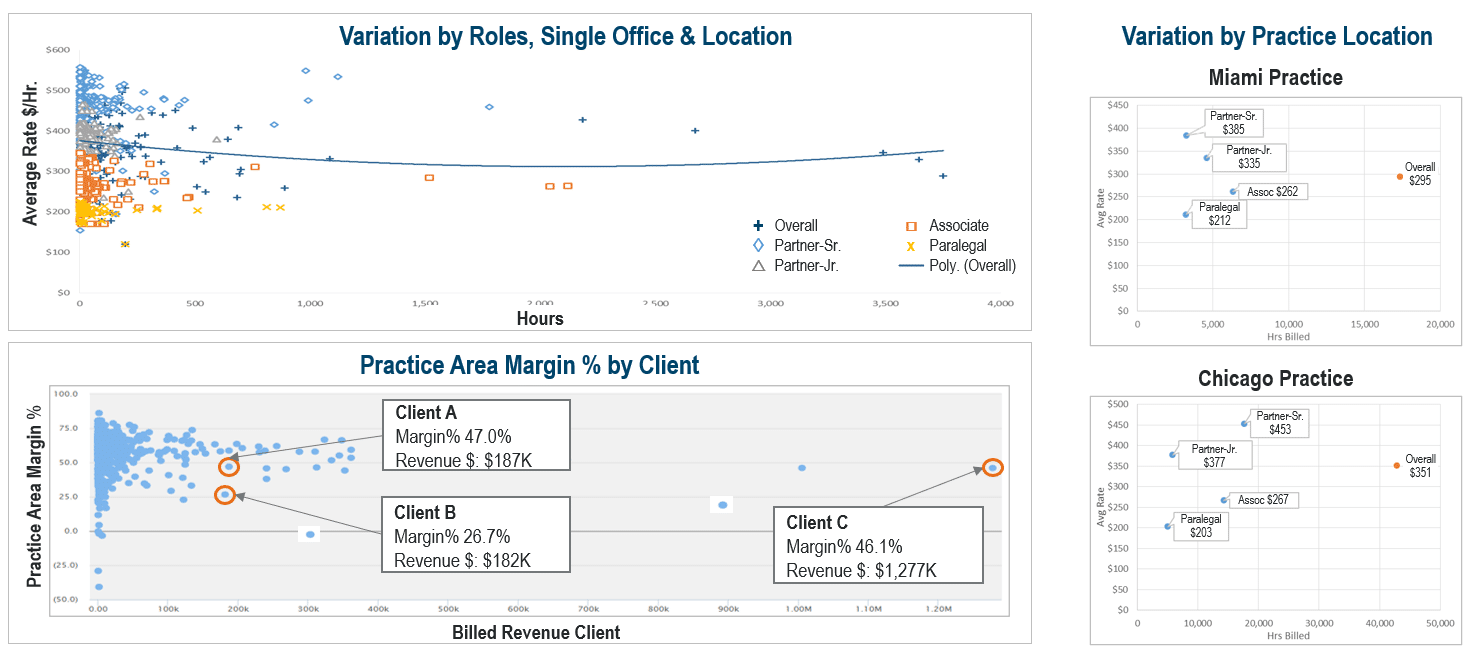

Driving Profitability with Decentralized Decision-Making

- Despite historical ~3% standard rate increases, lack of differentiation resulted in sub-optimal results

- High variability in rates across roles, locations, and practices

- Many unearned discounts being received by smaller clients

- Standard rates across similar roles did not align with market pricing

Quantitative Analysis

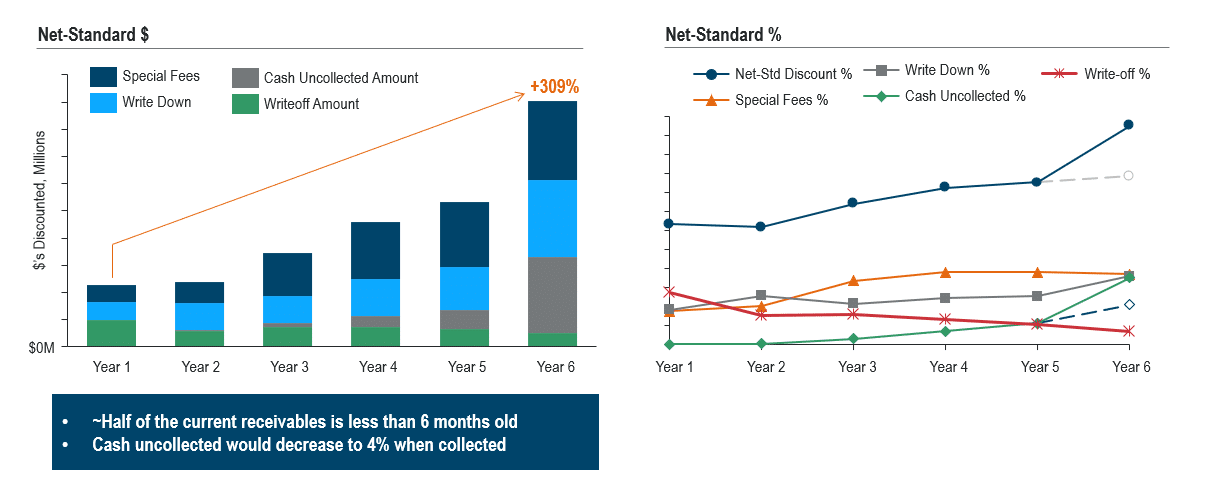

Discounting Trends

Approach

Differentiated, Market-Aligned Rates

- Built a gross-to-net waterfall to enable deeper, precise understanding of how standard rates translated to cash collected

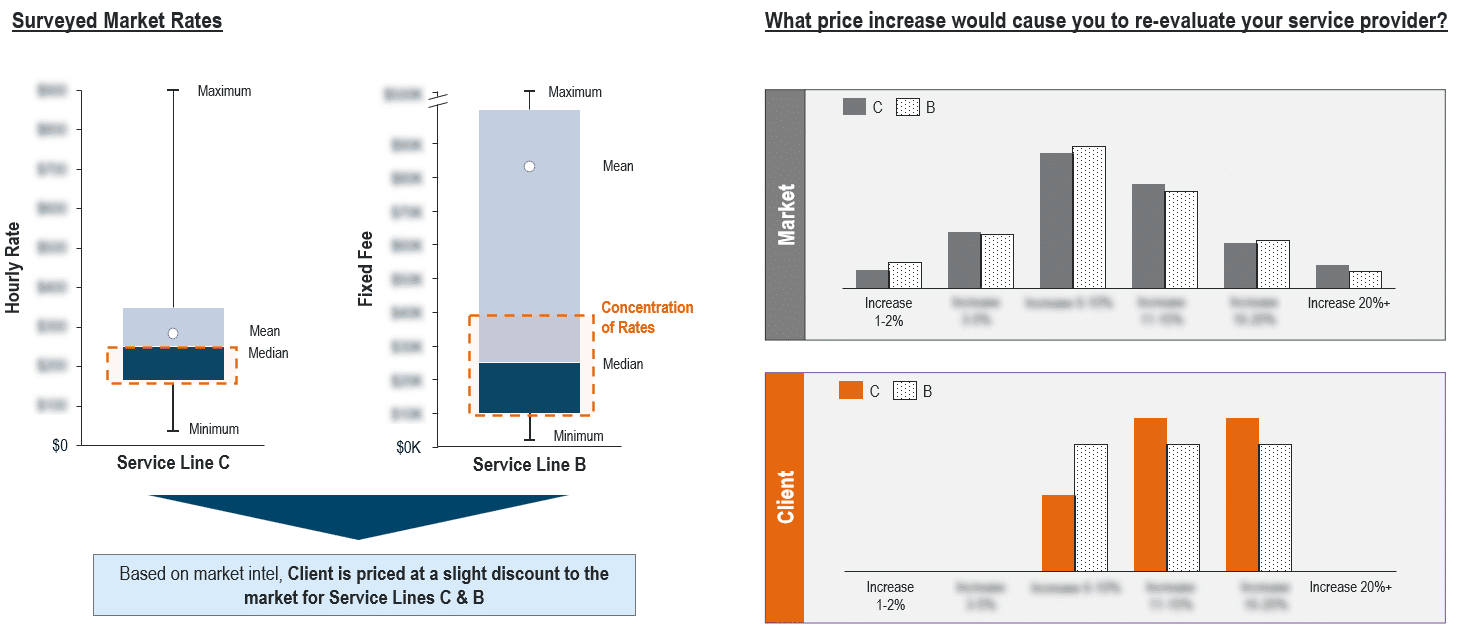

- Led market research study to understand current price positioning versus the market

- Reset rates across practice areas to reflect market positioning and recommended resource mix, leveraging existing price realization data and adjusting for existing rate variation

- Built a pricing model to set new client agreements, leveraging market data to inform target

- Implemented annual standard rate increase process

Market Intelligence

Gross to Net Waterfall

Sample Learnings:

- Individuals with high realization had greater opportunity to increase rates

- Practice Group Chairs benchmarked their teams’ realization against other teams

- Measuring changes in realization allowed the business to ensure that increases in Standard Rates were not discounted back to customer

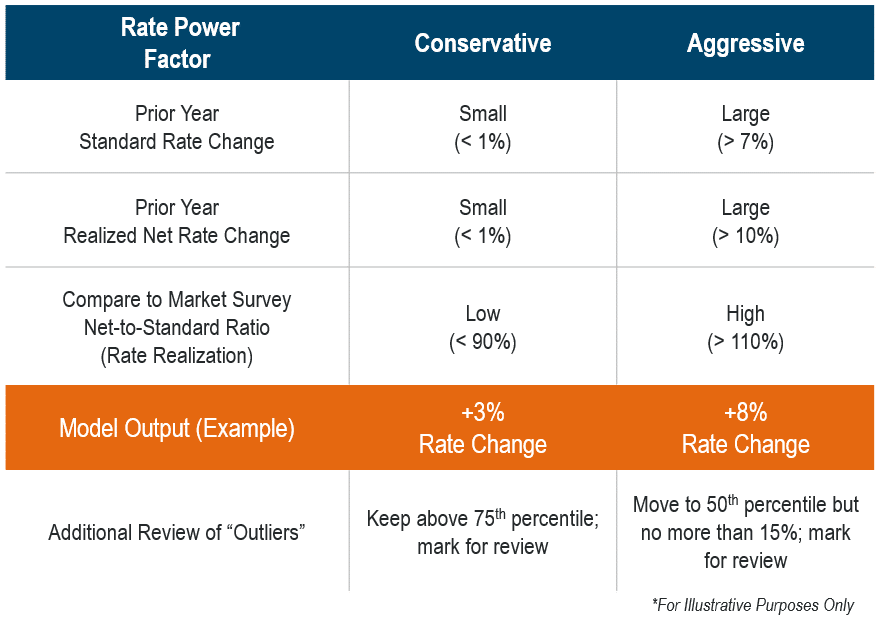

Differentiated Rate Increase

Differentiated pricing model based on historical and market data to determine optimal rate increase recommendations

5-Step Process:

- Analyze historical and market data

- Apply rate power factors

- Generate standard rate recommendations

- Review recommendations with practice chairs

- Finalize and communicate standard rates

Annual market-relevant rate increases based on a continuously updated model

- Established a score based on prior year performance

- Developed weighted scoring system to generate baseline rate increase cap

- Added caps to adjust for market relevancy or new business

Example Power Factors & Model Output:

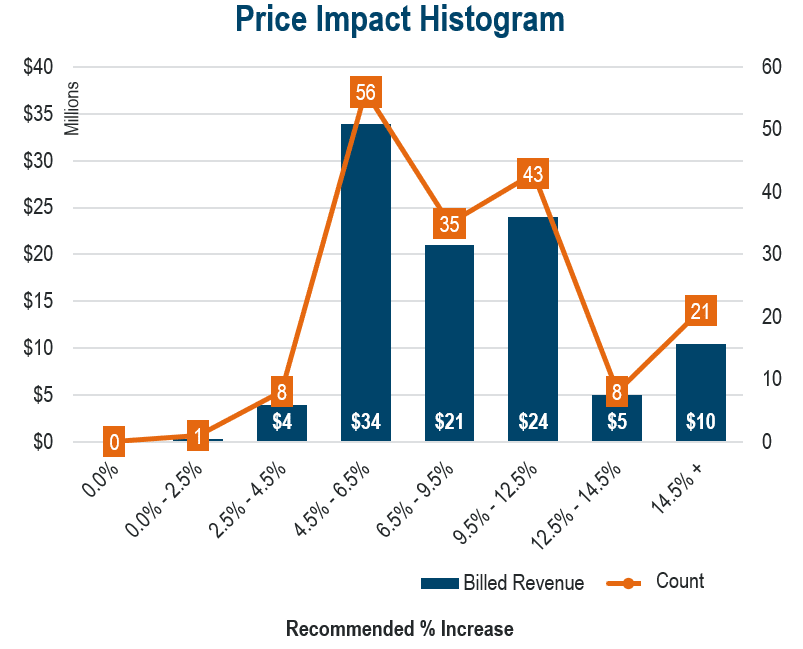

Example Impact from Recommended Increases:

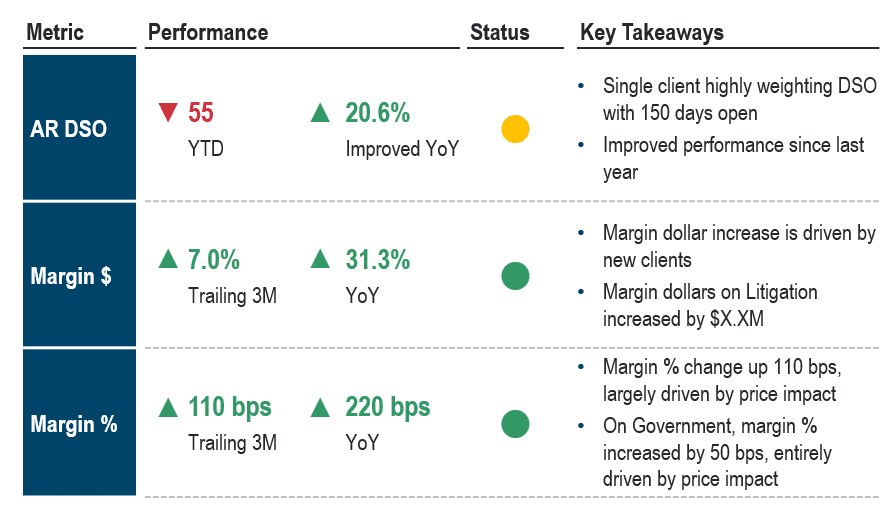

Collections Realization

- Developed account management technology to boost efficiency and centralize visibility through through tools such as automated email alerts and an embedded escalation process

- Weekly reporting at a client level

- Established commercial PMO focused on addressing profit leaks and trailing new approaches to maximize growth

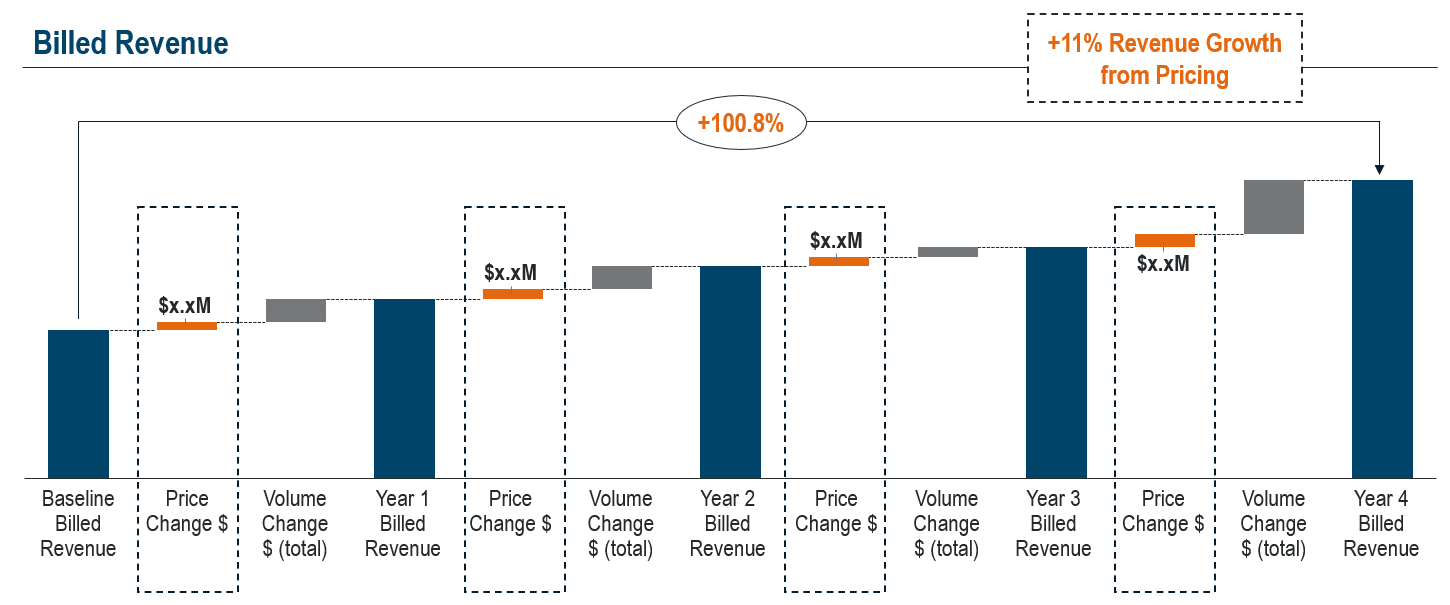

100.8% Billed Revenue Growth Over 4 Years

Alongside timely cash collections