Metals Processor and Distributor

Revolutionizing Pricing in Metals: A Playbook for Margin Growth

Mastering Market Volatility: How Dynamic Pricing Delivered $20M in Margin Growth

A metals processor and distributor harnesses data-driven pricing to overcome market challenges and boost profitability.

In a market defined by volatile raw material costs and fluctuating customer demand, this $1B metals processor and distributor faced significant challenges. Sales representatives had the autonomy to set prices, resulting in notable margin variation and a lack of confidence in pricing strategies. With a slow and cumbersome quoting process and outdated price books, the company struggled to maintain competitiveness. By implementing a dynamic pricing engine and aligning prices with commodity indices, they streamlined their pricing strategy, enhanced compliance, and unlocked $20M in margin improvement. This case study explores the transformative approach that turned market unpredictability into a profit-driving opportunity.

Explore More Case Studies

Situation

Pricing Autonomy and Volatile Markets Create Margin Challenges

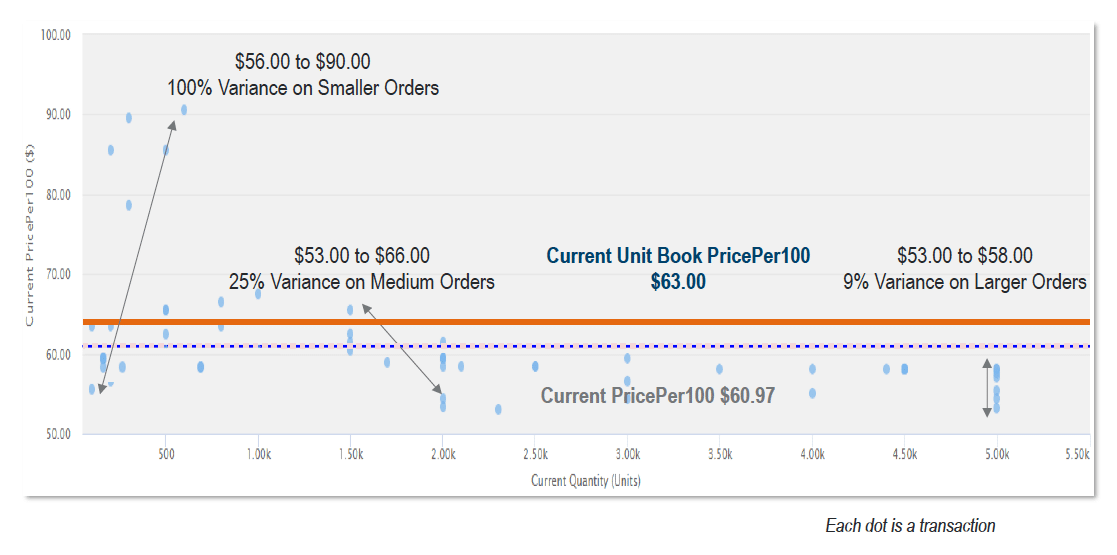

- Sales reps have autonomy to determine price for each transaction regardless of recommendation in an environment where raw material costs are highly volatile

- Volatile raw material costs driving the need to push out quotes with minimal consideration for price

- Limited margin differentiation and prior pricing was recycled in a quickly changing market due to a lack of trust in the price book

- Notable margin variation and a slow, cumbersome quoting process

Approach

Dynamic Pricing Engine Transforms Margin Management

- Developed a pricing engine to set market price by identifying the correct margin target and utilizing commodity indices to adjust prices on a frequent basis

- Updated the price book and built price floors with a review process

- Provided implementation training and measurement across regions

Cost changes affect margin