Specialty Chemicals Provider

Optimized Tariff Management for Enhanced Profitability

Understanding Tariff Exposure and Optimizing Tariff Recapture Plan

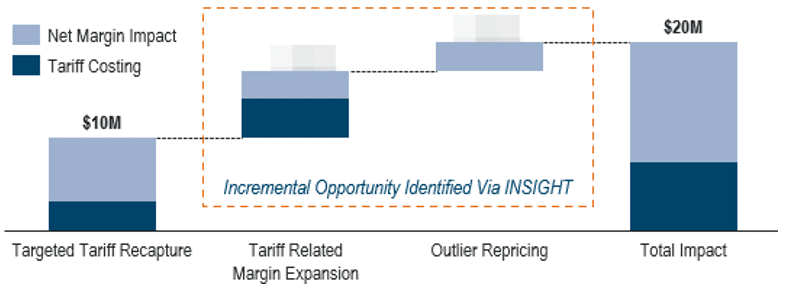

A specialty chemicals distributor optimized their existing tariff recapture workstream to identify $10M of incremental revenue opportunity.

This specialty chemicals distributor faced significant margin erosion due to limited visibility to real-time costs, ongoing ERP transformation challenges, and decentralized pricing autonomy. By thoroughly assessing the tariff recapture methodology, we uncovered $7M in unrecognized tariff exposure and identified $3M in low-margin pricing outliers for correction. Implementing a dynamic model to strategically offset tariffs while preserving margin neutrality allowed the client to optimize pricing strategies, resulting in a substantial boost to profitability.

Explore More Case Studies

Situation

Facing Margin Erosion Amid Cost Volatility

- Limited visibility into real-time costs led to ongoing margin erosion

- Historical acquisitions and subsequent ERP transformation made reporting challenging

- Sales reps had nearly full autonomy over pricing, relying on individual expertise

- Pricing for key products was heavily influenced by commodity index fluctuations

- Relatively healthy margin spread between customers and products with opportunity for improvement

- ERP constraints made price updates and performance tracking highly manual

Tariff Related Margin Expansion Opportunity

Approach

Unlocked Untapped Growth Through Strategic Tariff and Price Modeling

- Assessed and validated the business’s tariff recapture methodology for effectiveness, identifying an additional $7M of tariff exposure that was not identified and included in the current execution plan

- Completed additional modeling to identify an additional $3M of low-margin price outliers for the client to correct during the same repricing event

- Implemented a dynamic situational model to strategically offset tariffs

- Ensured all tariff-related pricing adjustments maintained margin rate neutrality

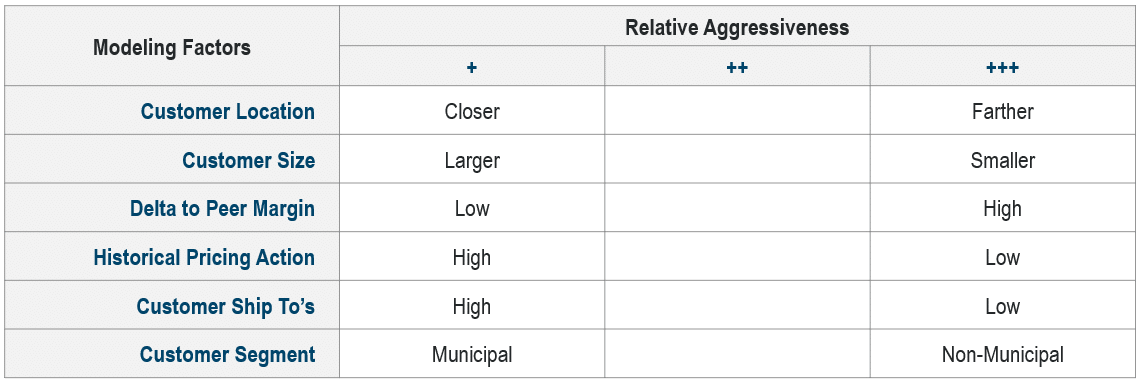

Situational Model Framework

Combined historical pricing data, key customer attributes, and real-time market dynamics to determine the optimal tariff strategy and level of pricing aggressiveness