Top 7 Pricing Analyses to Optimize Your Pricing Strategy

Businesses run on data. Yet for pricing leaders, harnessing the power of their company’s data to make informed data-driven pricing decisions is often a significant challenge. While most companies have implemented some type of pricing analysis program—from sophisticated pricing software to price consultants that interpret data—most businesses still miss critical information that would result in increased profits year over year.

In this article we reveal the top pricing analyses utilized by world-class pricing organizations to continuously optimize pricing impact. This set of foundational analyses will help you reliably extract action-driving intelligence and expose blind spots to strengthen your short- and long-term pricing strategy.

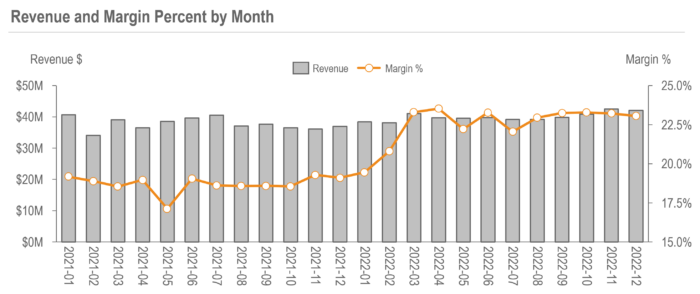

#1 – Revenue and Margin Trends

What are Revenue and Margin Trends? Likely something your business is already utilizing, this type of analysis charts the revenue and margin amount (dollar and/or percent) your business is seeing each month, year, or other set frequency. This can be analyzed by individual business segments or as a whole.

Why this pricing analysis is valuable:

- Provides organizational visibility and alignment to revenue and margin results

- Surfaces cyclical trends in revenue and margin

- Reveals where margin may be improving despite revenue degradation, or vice versa

- With the ability to view revenue and margin trends by business unit, region, product line, customer type, end market, or other grouping, pricing leaders can pinpoint where targeted, versus wide-sweeping, pricing action should be taken

How to elevate your pricing strategy:

- Establish pricing practices that support cyclical trends such as seasonality

- Parse out where certain product lines, customer types, or end markets require updated margin targets, pricing policies, or sales effectiveness solutions to combat declining margin or revenue trends

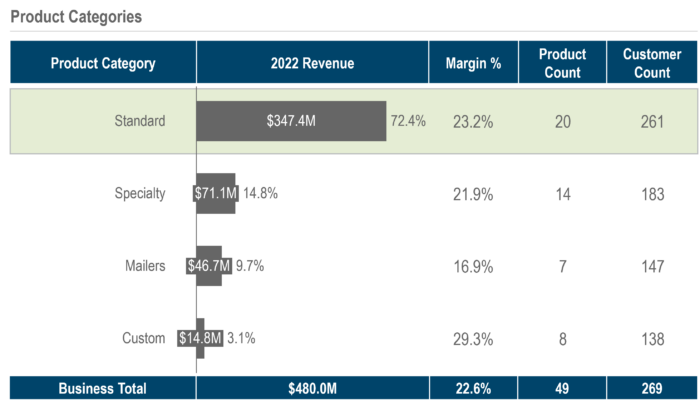

#2 – Share of Revenue and Margin by Key Segments

What is Share of Revenue and Margin? Revenue and margin share analysis presents the amount of revenue or margin each business segment is contributing to the overall revenue or margin of the business. From this pricing analysis, you can identify key drivers of Margin Mix.

Why this pricing analysis is valuable:

- Classifies which business segment is driving revenue and margin

- Identifies segments of the business influencing margin mix

- Pinpoints where overall company margin has changed as mix shifts – e.g., may earn new business within a new segment that causes overall margin to decrease, even if core business margin is increasing

How to elevate your pricing strategy:

- Review existing customer and product segments and consider a more in-depth micro-segmentation exercise for more optimal groupings

- Leverage customer and product segmentation to align price to value and influence positive mix improvement

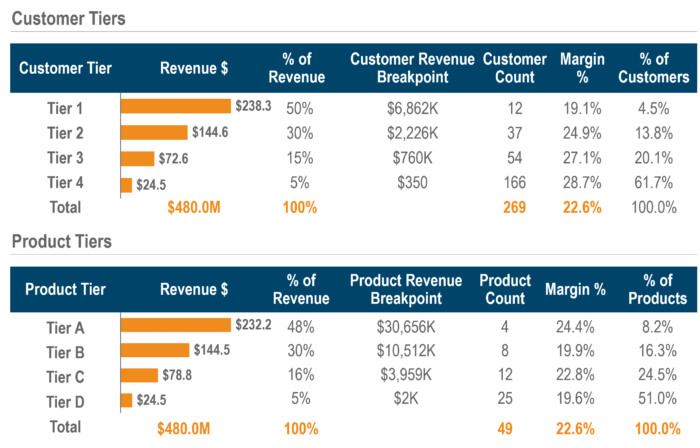

#3 – Customer and Product Tiering

What is Customer and Product Tiering? Customer and product tiers are used to group customers and products based on their contribution to overall revenue. For example, a tier 1 customer makes up the top 50% of revenue, while a tier 4 customer makes up the bottom 5% of revenue. In this scenario, we would expect that the higher the tier, the lower the expected margin rate.

Why this pricing analysis is valuable:

- Identifies which customers and products make up the largest and smallest portion of your revenue

- Helps identify risk in revenue concentration and drive opportunity in margin maximization on tail customers

How to elevate your pricing strategy:

- Use customer and product tiers as a segmentation factor in your pricing model such that customer and product importance is captured relative to pricing

- Conduct a SKU rationalization study to understand which SKUs may be unprofitable and unvaluable to the customer

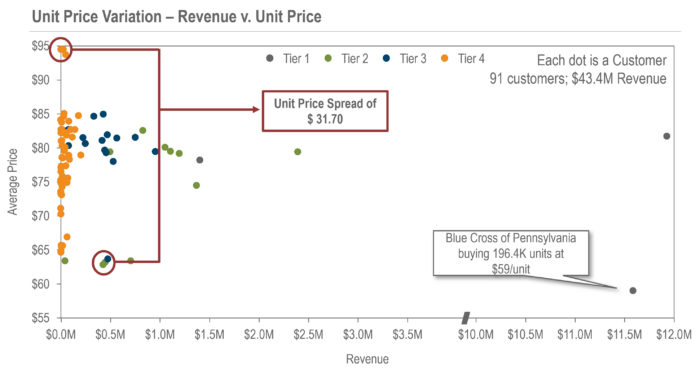

#4 – Price / Margin Variation

What is Price / Margin Variation? This is typically a scatter chart plotting similar customers (e.g., end market, region, or tier) purchasing the same or similar products by the amount purchased and the price or margin %. We would expect similar customers purchasing similar products to have consistent price points and margin rates.

Why this pricing analysis is valuable:

- Reveals price outliers – that is, customers who are paying significantly less or more than their peers due to inconsistent pricing policies

- Pinpoints specific customer-product transactions that should be flagged for pricing action

- Can draw conclusions based on regional, product line, or salesperson trends

How to elevate your pricing strategy:

- Implement differentiated price adjustments to bridge the gap for price outliers – some customers may take time to raise price to appropriate levels, others may require risk management

- Conduct ongoing reviews to manage price/margin outliers

- Build pricing policies and a governance structure to ensure sales is following the price recommendations

#5 – Price Measurement

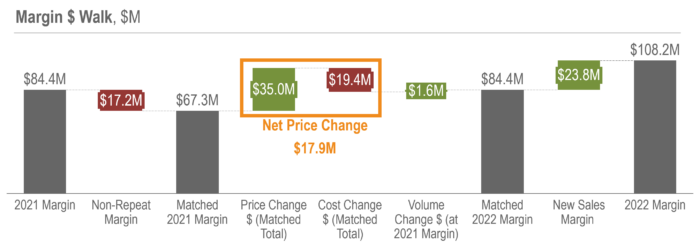

What is Price Measurement? Price measurement is a set of analyses that show how pricing activities have affected revenue and margin. A few examples include:

- Revenue Walk – Track where changes in price and volume have contributed to changes in revenue

- Margin & Margin % Walk – Track where margin or margin % growth is directly attributed to price changes; also able to measure price impact net of cost changes

- Price versus Cost (Actual or Commodity Index) Trends – Uncover where cost changes may have outpaced price changes, or vice versa

- Price Change % & Price Realization – How much of price was captured through a price change versus the amount you expected to capture

Why this pricing analysis is valuable:

- Indicates if and how your pricing activities are performing – e.g., are price increases keeping up with cost increases

- Signals if changes to sales processes, sales training & incentives, or pricing policies are required to better capture results from pricing actions

How to elevate your pricing strategy:

- Ensure sales incentives align to pricing goals – e.g., tie commission to margin versus sales revenue

- Conduct sales training on price recommendations and approval processes, especially when price changes occur

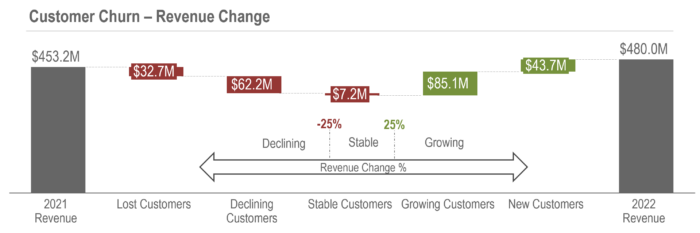

#6 – Customer Churn

What is Customer Churn? Customer churn tracks the percentage of customers who have stopped purchasing your product or service over a specific time frame. Typically, it costs businesses significantly more to acquire new business than to retain existing business, making customer churn an important metric to manage.

Why this pricing analysis is valuable:

- Pinpoints which regions or customer segments are experiencing higher or lower customer churn than expected, enabling you to better identify the dynamics driving the change

How to elevate your pricing strategy:

- Identify triggers to customer churn and analyze as it is happening – review at a set cadence and implement processes to intervene and prevent churn

- Implement sales effectiveness programs, such as account planning, loyalty programs, or cross- and up-selling initiatives, to combat and manage customer churn

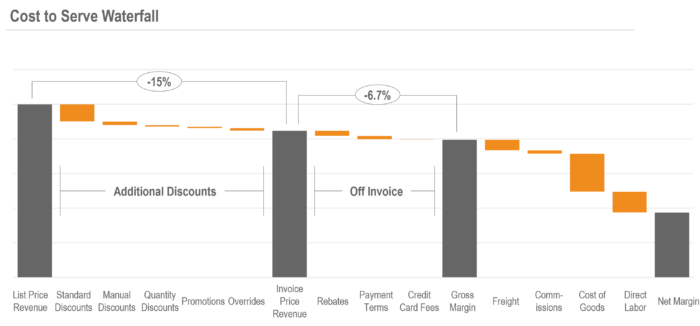

#7 – Cost to Serve Waterfall and Price Leakage

What is Cost to Serve? A cost-to-serve waterfall begins with your gross revenue and calculates all the additions and subtractions that lead to net margin. This can be done by customer groups, product groups, regions, end markets, or any segment of your business. Every item in the waterfall that alters your net revenue can be considered an area where a potential price leak could occur. This includes items such as trade spend, rebates, discounts, and freight.

Why this pricing analysis is valuable:

- Helps understand true margin net of on and off invoice programs

- Surfaces areas of potential margin leaks

How to elevate your pricing strategy:

- Analyze the effectiveness of existing pricing policies, such as:

- Tackle unwarranted discounting

- Ensure sales compensation is based on price waterfall elements and business goals

- Generate a freight pricing strategy that accounts for customer segmentation and fluctuating costs

- Deploy systems of ongoing measurement and accountability to ensure adherence to pricing policies

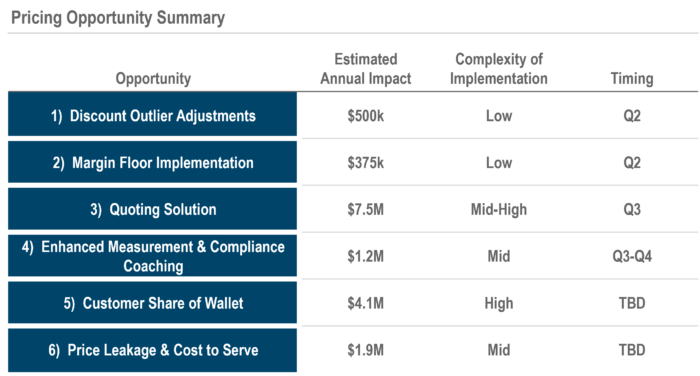

Improve Your Pricing Strategy in Weeks with INSIGHT2PROFIT

All strategic pricing programs should include these pricing analyses—and more. If leveraged correctly, data drives smart decisions and bottom-line impact. If you need help getting your data to a place where you can consistently and reliably utilize these pricing analyses, INSIGHT can help. In just a matter of days, we can translate messy data into actionable insights and quantify areas of pricing opportunity.

Then, INSIGHT can help set your business up with the best set of analyses that drive the most profitable decisions ongoing. Pricing decisions should not be made in a vacuum—let INSIGHT help.